Digital transformation is the process of transitioning from traditional business practices to those that are more reliant on digital technologies. It’s a way to use technology to improve your business processes and make your company run better and make more money.

One area where digital transformation has had a significant impact is in the payment industry. According to the report, the global digital banking platform market size is expected to grow from USD 10.87 billion by the end of 2027, at a compound annual growth rate (CAGR) of 13.6% from 2020 to 2027.

In this post, we’ll take a closer look at how digital transformation is leveraging the payment industry and how it’s benefiting both consumers and businesses alike.

What Is Digital Transformation?

You might be wondering what digital transformation is. Put simply, it’s the process of evolving your business to meet the demands of the digital age.

There’s no question that we’re living in a digital world. We rely on technology for almost all our tasks in modern times, from banking and shopping to communicating and learning. So, if your business isn’t embracing digital transformation, you’re already behind the curve.

Digital transformation isn’t just about operating a website or an app. It’s about using technology to create better customer experiences, make your processes more efficient, and increase your bottom line. And that’s where the payment industry comes into play.

What Are the Benefits of Digital Transformation?

The payment industry is one of the most crucial components of digital transformation. After all, this allows customers to pay for the products and services they want.

But what are the benefits of digital transformation? There are many, but some of the most important ones are more efficiency, lower costs, and a boost in customer satisfaction.

Let’s take a better look at each of these benefits. With increased efficiency, businesses can get products and services to customers faster and more efficiently. This is thanks to eliminating paper-based processes and introducing new technologies that make transactions faster and more accurate.

Reduced costs are another key benefit of digital transformation. Businesses can save a lot of money by automating processes and eliminating the need for human involvement. And improved customer satisfaction goes without saying. When customers have a good experience with a business, they’re more likely to return and recommend it to their friends.

How Is Digital Transformation Affecting the Payment Industry?

You might be wondering how digital transformation is affecting the payment industry.

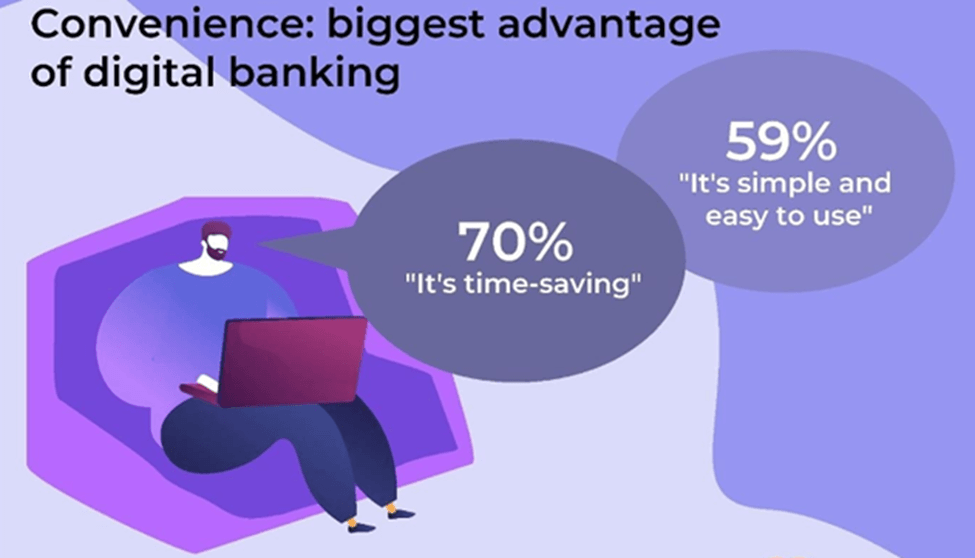

Well, to start with, there’s a big move towards digital payments. More and more people prefer to pay for things online or with their phones, and businesses are responding by offering more and more ways to pay.

The problem is that this can be a bit confusing for customers. There are so many options, and it’s not always clear which is the best way to go. This is where the payment industry comes in.

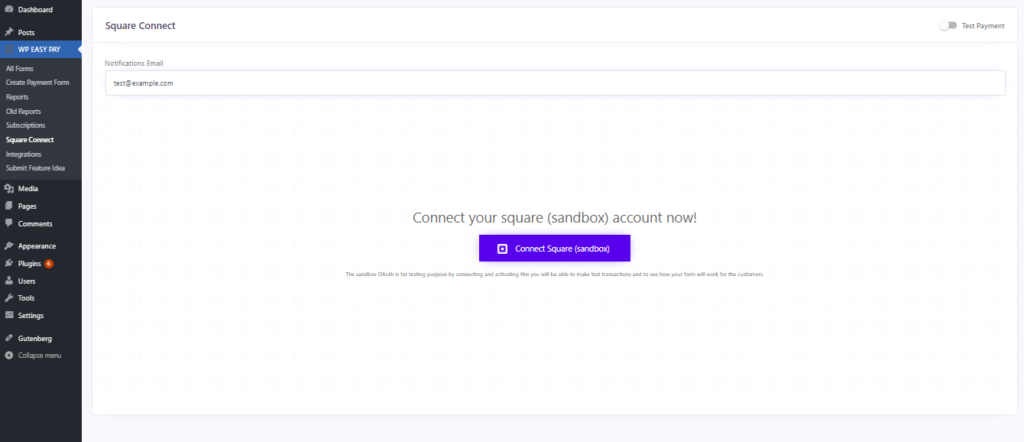

Payment companies are working hard to make it easier for customers to pay for things online. They’re developing new technologies that make it faster and easier to pay, and they’re also trying to create a standard for online payments so that customers know what to expect.

So, as you can see, the payment industry is playing a significant role in the world of digital transformation.

What Trends Are Emerging in the Payment Industry as a Result of Digital Transformation?

Well, a few key trends are emerging as a result of all of this change.

For one, we’re seeing a move towards more digital payments. More and more people are using their smartphones to make payments, which is something that will only continue to grow. In fact, a recent study found that over 60% of people would prefer to use their smartphone to make a payment then use any other method.

Another trend we’re seeing is the rise of mobile wallets. This is an excellent way for customers to store all their payment information in one place, and it’s something that’s been growing in popularity over the past few years. In fact, a study by Juniper Research found that the value of mobile wallet transactions will reach $2.5 trillion by 2021.

These are just a few examples of how digital transformation impacts the payment industry. The bottom line is that things are changing rapidly, and businesses need to keep up with these trends if they want to stay competitive.

How Can Businesses Leverage Digital Transformation in the Payment Industry?

In the payment industry, there are a lot of ways that businesses can leverage digital transformation. Here are just a few:

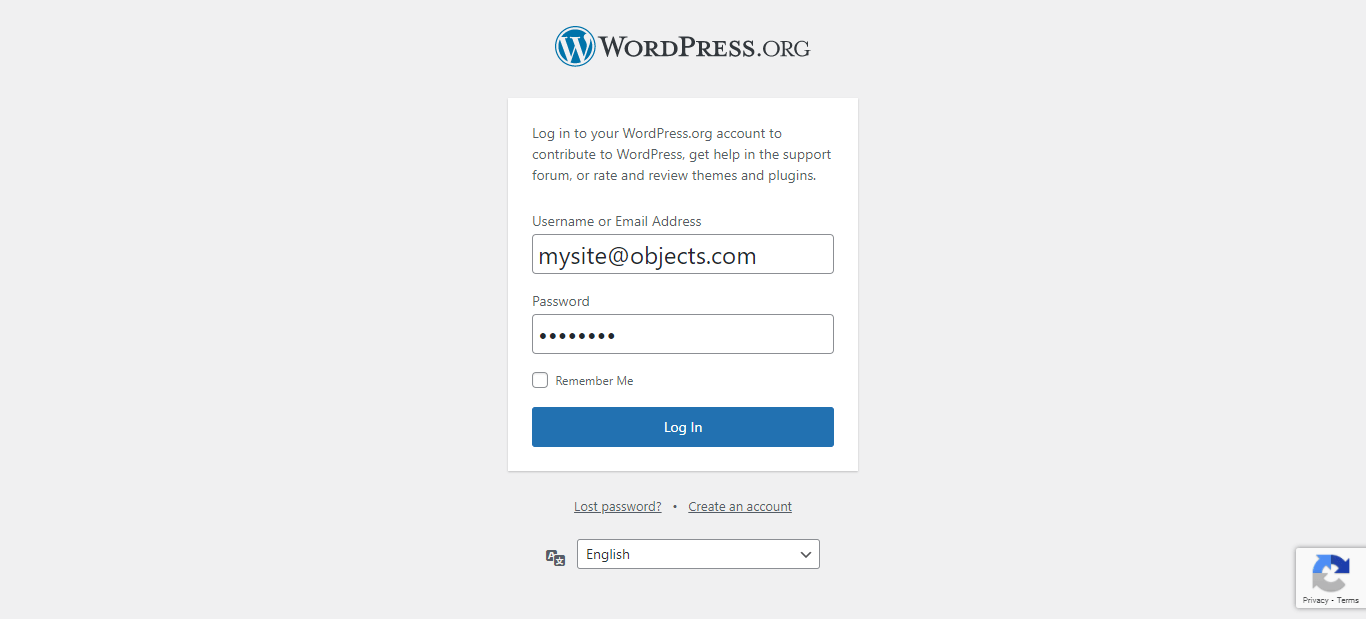

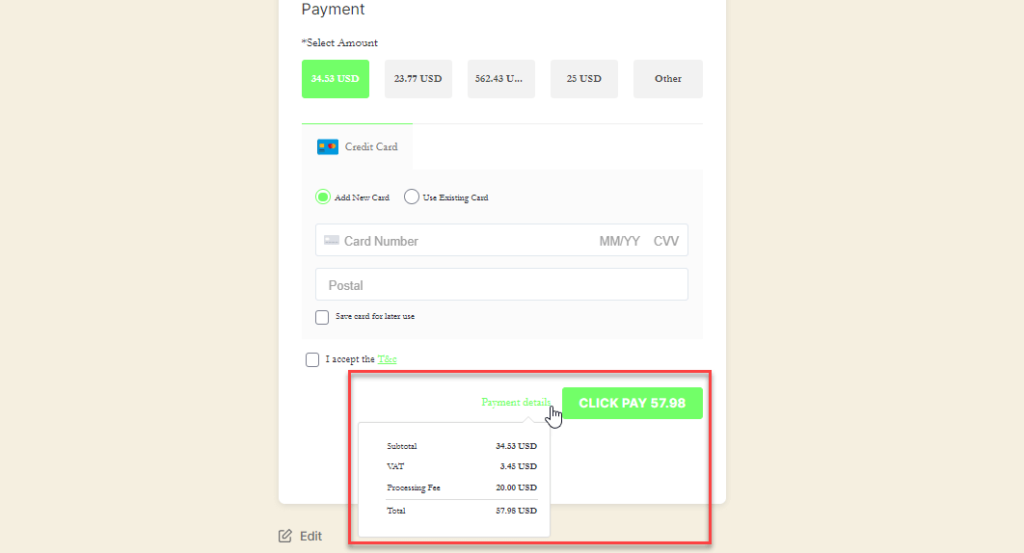

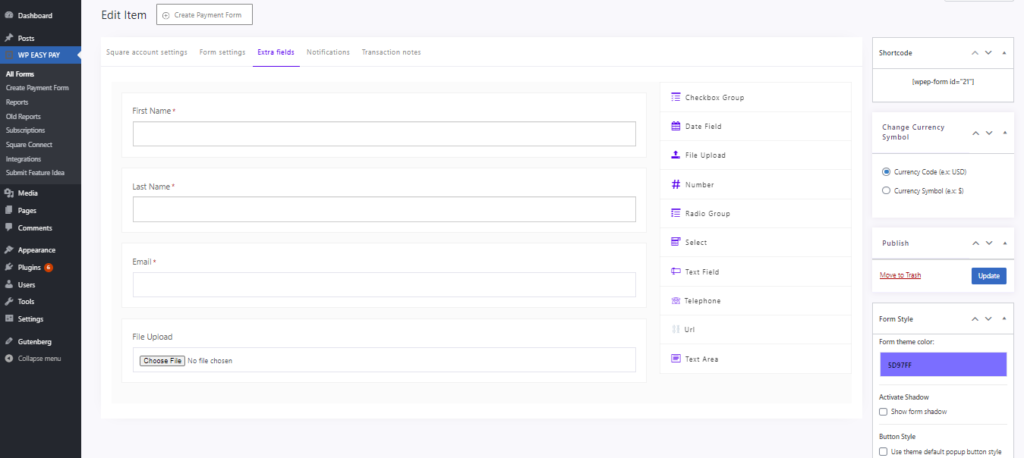

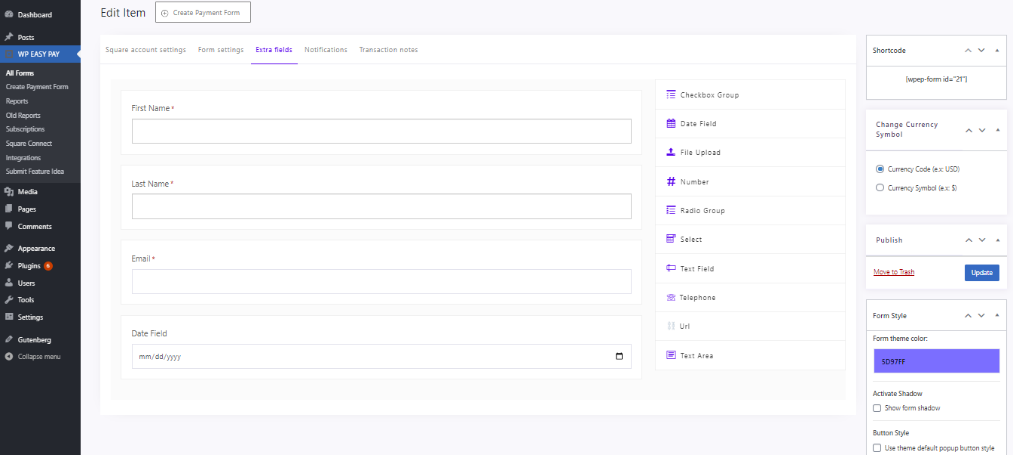

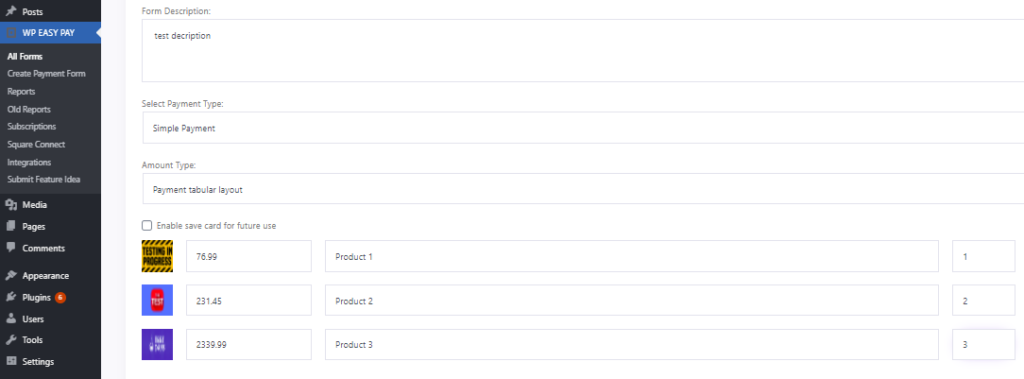

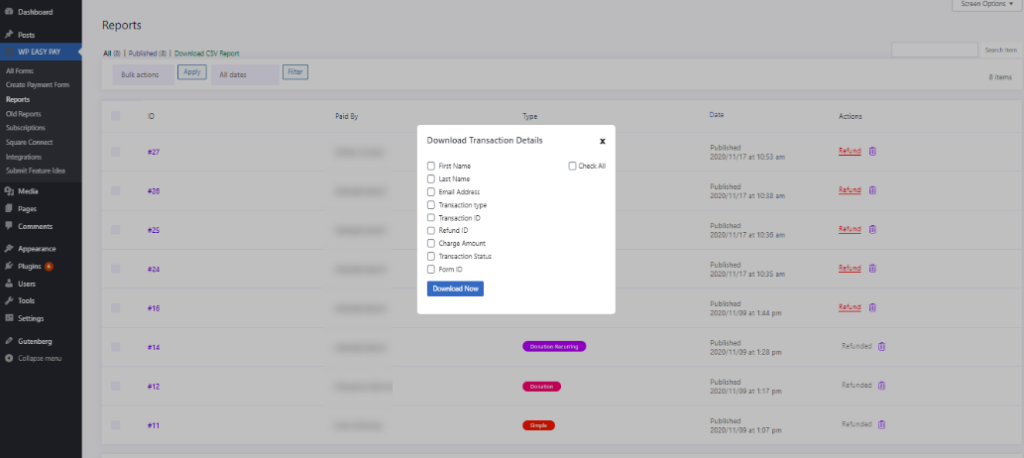

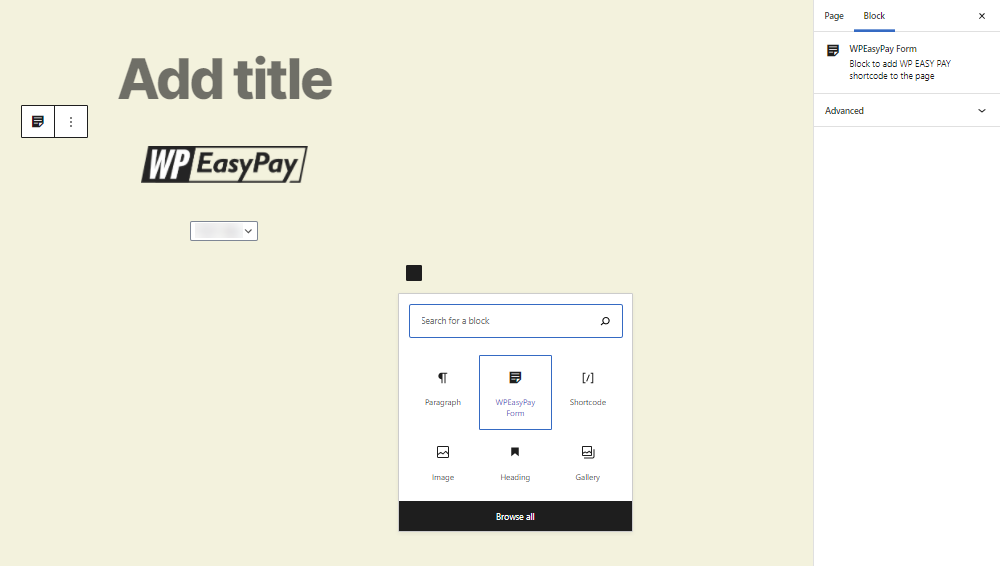

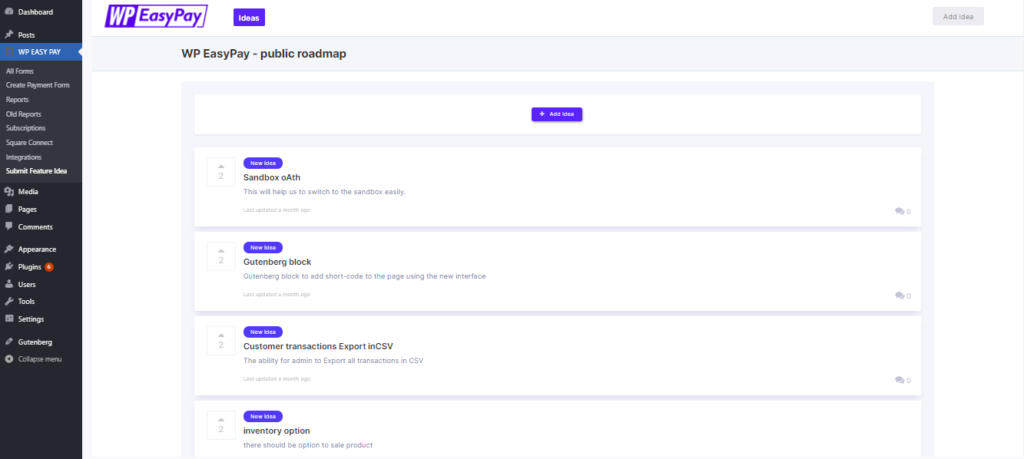

- Use digital channels to process payments. This can include online payments, mobile payments, and even contactless payments.

- Use digital technologies to help you manage your finances. This could include cloud-based accounting software or invoicing tools.

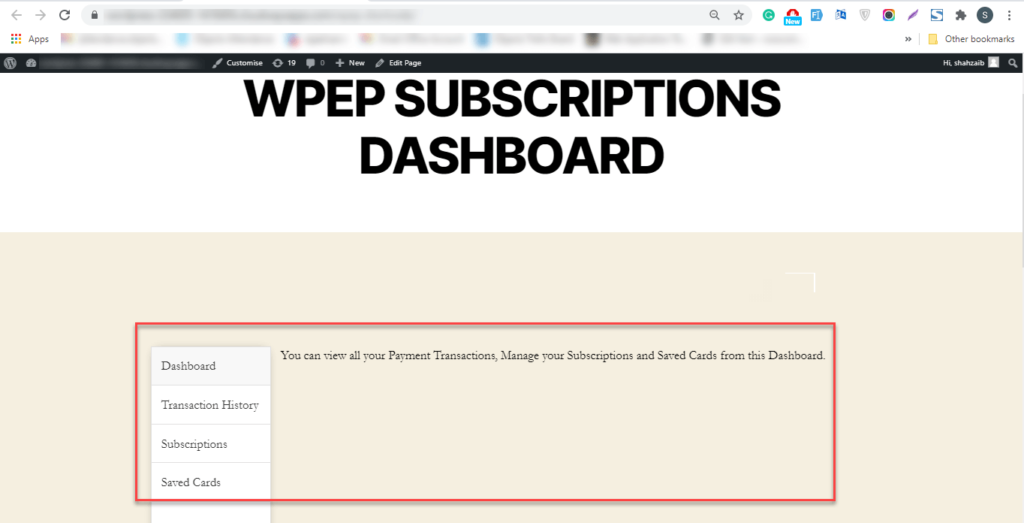

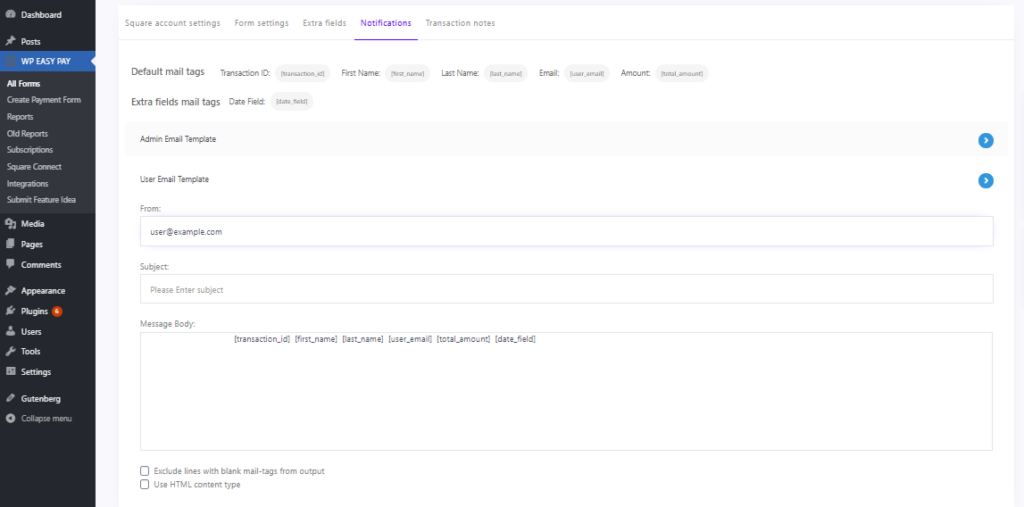

- Use digital tools to improve customer service. This could include chatbots or customer support channels that are available 24/7.

- Use digital marketing tools to promote your products and services. This could include email marketing, social media marketing, or targeted ads.

- Use data analytics to track and analyze your sales and marketing efforts. This could help you identify trends and optimize your campaigns for better results.

What Challenges Does Digital Transformation Present for the Payment Industry?

The answer is that it presents a lot of challenges. For one thing, the way people pay for things is changing. They’re using their phones and other devices to make payments, which is putting a lot of pressure on the payment industry to keep up with the latest technologies.

Another challenge is that as more and more businesses go digital, they’re becoming less reliant on traditional payment methods like credit cards. This is causing a lot of disorder in the payment industry as companies scramble to find new ways to make money.

It’s a challenging time for the payment industry, but I do not doubt it will find a way to adapt and thrive in the digital age.

The Verdict

Technology has progressed to the point where almost anything can be done online. This means you can purchase items online and pay for them without ever having to leave your home.

The payment industry has definitely taken advantage of this technological advance. It has made it possible for customers to pay for items without ever having to worry about leaving their comfort zone. In addition, the payment industry has also made it possible for customers to pay for items using various methods, including debit cards, credit cards, and even PayPal.

So, if you’re searching for an easy and quick way to pay for your online purchases, the payment industry has you covered. All you need is an active debit or credit card, and you’re good to go.