Payment processing helps businesses accept payments securely and reliably. Payment processors are used for both online and in-person transitions. They help transfer cash from the payor to the payee.

The payment processing method that seems instant to us is actually a very lengthy process that requires multiple components and tons of communication between networks to make the transition successful.

In this article, you will learn what payment processing is, its benefits, how it works, its main components, and lastly, the best practices for using payment processors.

Without further ado, let’s jump right in.

What is Payment Processing?

Payment processing helps businesses accept payment from customers. There are two types of payment processing:

- Traditional

- Open Banking

Traditional banking involves banks and credit unions handling all financial services and keeping customer data within their secure systems. Customers rely solely on their bank’s products, limiting their options to what each bank offers.

On the other hand, in open banking, customers have more control over their data. They can choose to share it securely with third-party financial providers through APIs (Application Programming Interfaces). This allows people to access a wider range of services beyond a single bank and explore more personalized financial options.

In a nutshell, traditional banking keeps everything within the bank’s system, while open banking lets customers share data with other companies for a more flexible and personalized experience.

Open banking provides relatively more benefits, including lower transaction costs, allowing customers to save their payment information, enabling users to pay quickly, and eventually reducing friction.

Benefits of Smooth Payment Processing

A robust and secure payment processing system is vital for business. It allows easier transactions and helps build trust between the customers. Here’s how payment processing helps:

- Customer Trust and Convenience: A smooth, secure payment process helps build trust and encourages customers to complete purchases. Businesses that offer multiple payment options enhance convenience by allowing customers to choose their preferred way of purchasing. A typical eCommerce platform supports around 140 different payment options. Although you can’t offer all of them, you can go for the most common ones.

- Conversion Rates: A well-designed payment system reduces cart abandonment, as customers are more likely to complete transactions if the process is fast, easy, and reliable. Complex or lengthy checkout steps cause 17% of total abandoned carts.

- Security and Fraud Prevention: A robust payment processing system includes security protocols, such as encryption and tokenization, which protect sensitive customer data. This reduces the risk of chargebacks and other cyber frauds that can impact both the customer and the business.

- Customer Retention: Smooth and secure payment experiences help customers return. Moreover, you have a 60%-80% chance of selling to your existing customers and only a 5%-20% chance of selling to a new one. Offering options like one-click payments, saved payment details, and secure open banking options can keep customers coming back, and since selling to returning customers is easier, this can help your business grow in the long term.

Components of Payment Processing

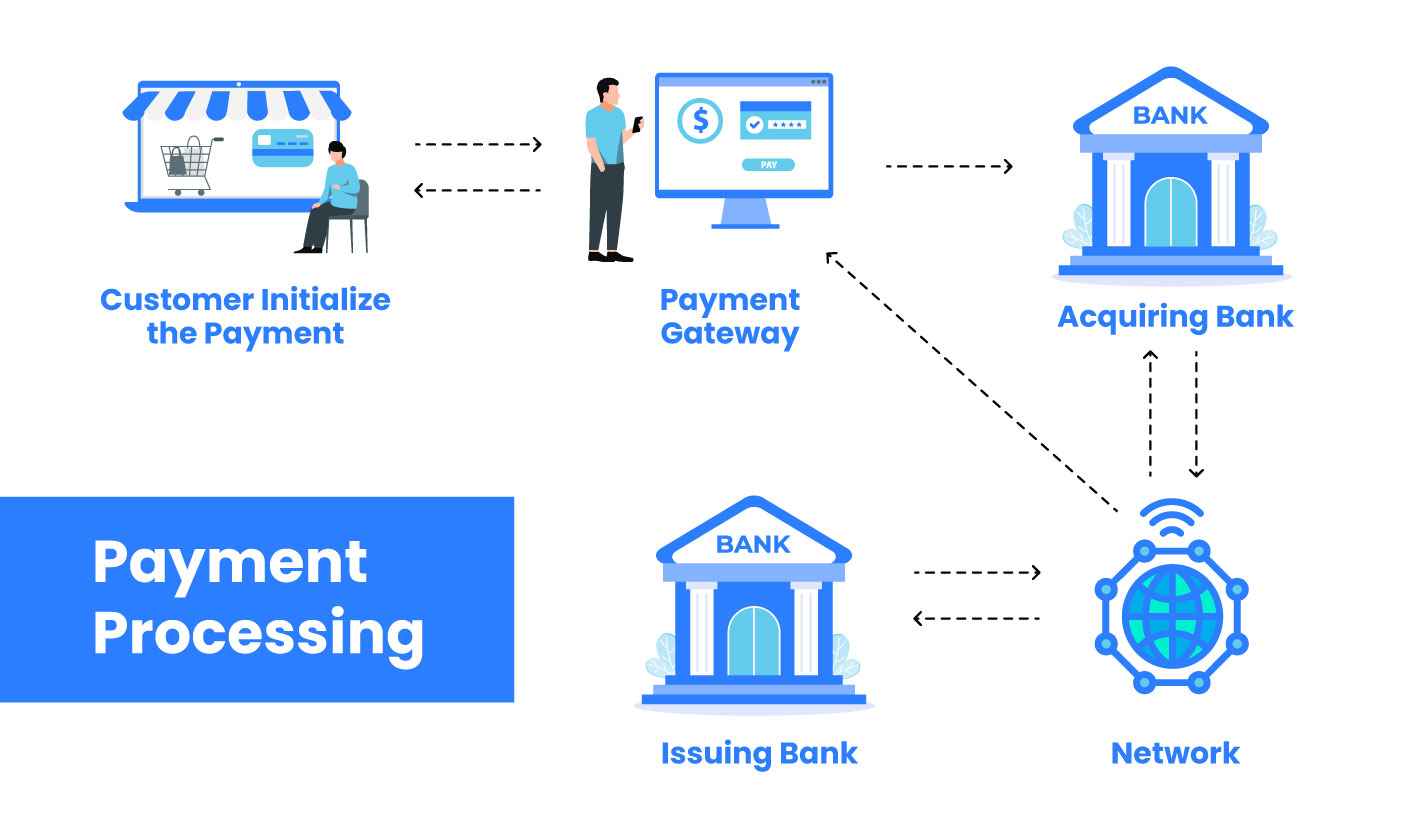

As discussed earlier, what seems like an instant process is actually very tangled. Here are the involved entities that make the processing of payment possible.

- Merchant: The one selling the service or goods; it can be an individual or a business.

- Customer: The one buying the service or goods; it can be an individual or a business.

- Payment Gateway: An intermediary between the merchant and the banks. It conveys the payment information from the customer to the payment processor (banks) and back to the merchant.

- Payment Processor: The processor of the payment or the communicator that communicates with the issuing bank, acquiring bank, and payment gateway to make the transaction possible.

- Issuing Bank: The bank responsible for issuing the card or being used for making the transaction. It evaluates the customer’s transaction attempt and approves or declines it if the transaction exceeds the available amount in the account or other account problems.

- Acquiring Bank: After approval from the issuing bank, the acquiring bank receives the amount and is responsible for depositing it into the merchant’s account.

- Payment Networks: Payment Networks—including card issuers like VISA and MasterCard, American Express, Discover, UnionPay, Amex, etc., ACH Payments networks like Originating Depository Financial Institution (ODFI) and Receiving Depository Financial Institution (RDFI) communicate between the issuing and acquiring banks.

- Security Protocols: Security protocols such as tokenization, encryption, PCI DSS, 2FA, etc., ensure the safety of the payment information and protect it from being stolen.

How These Components Work Together: Step-by-Step

Now that you know the main components of payment processing, let’s look at a simple example to understand how payment processing works. Let’s establish that a user lands on an eCommerce website and likes a product. Here’s how the payment processing will work to make the transaction possible.

Step #1: Customer Initialize the Payment

After the customer likes the product, they decide to add it to the cart, and finally, they fill out the checkout form that includes the billing address and enter their credit card information.

Step #2: Payment Gateway Processes the Transaction

After the customer enters their payment information, it is securely conveyed to the payment gateway. The gateway then communicates with the payment processors. Afterward, it encrypts the transaction data and sends it to the payment processor.

Step #3: Acquiring Bank Reroutes the Transaction

As soon as the payment processor receives the transaction data, it validates the information and forwards it to the acquiring bank. After the acquiring bank receives the transaction data, it reroutes information to the card network for validation.

Step #4: Card and Account Verification

Once the card network checks the card and accepts it, it sends the information to the issuing bank. The bank checks the customer’s account to ensure sufficient funds or credits. If the funds are sufficient, the payment is accepted; otherwise, it is rejected.

Step #5: The Payment Processor Closes the Transaction

After accepting or declining the transaction, the issuing bank sends the information to the acquiring bank via the card network, which then re-routes it to the payment processor. The processor then communicates with the website or the POS system (for physical businesses) through a payment gateway.

02 Common Types of Payment Processing

As we discussed earlier, both online and tangible businesses can benefit from payment processing. Here’s how it works:

#1: In-Person Payment Processing

In-person payment processing involves face-to-face transactions where customers pay at a physical location, often using a POS (Point of Sale) system. Retail stores, restaurants, and service providers use services like Square or mobile card readers to handle credit and debit card payments.

???? ICYMI: You can accept payment on your WordPress using Square, and WP EasyPay makes connecting Square to your WordPress effortless.

These systems process payments instantly. Many POS systems also support contactless payments, such as Apple Pay or Google Pay (GPay), enabling customers to tap their phone or card for quick, secure transactions.

#2: Online Payment Processing

Online payment processing enables customers to make payments through e-commerce websites, apps, or digital platforms. Businesses use payment gateways to securely process credit, debit, digital wallet, or ACH payments.

These systems protect customers’ sensitive data and help build trust. Online payment processing supports a variety of payment methods, including digital wallets like PayPal, Cash App, etc., and options like Buy Now, Pay Later (BNPL) services such as Afterpay. These options enhance convenience by enabling customers to pay in easy installments, making it essential for online businesses.

Key Security Measures in Payment Processing

The process follows PCI Compliance standards to handle and store card information securely. Payment processors use encryption to secure transactions and convert data into unreadable code. This ensures that only the other component of the process can access it.

Many providers also rely on tokenization, which is a technology that replaces card information with unique tokens, so businesses don’t store sensitive data directly.

To prevent fraud, businesses employ fraud detection tools like address verification, CVV checks, and artificial intelligence-based systems that identify suspicious patterns. When these protocols find something suspicious, they reject the transaction, saving the merchant from potential loss.

Payment Processing Fees and Costs

Payment processing fees and costs typically include a few key charges.

First and foremost, businesses pay transaction fees for each payment. The charges vary depending on the service. However, it’s often a percentage of the sale amount plus a flat fee. For example, credit card processors may charge around 2.9% plus $0.30 per transaction.

Businesses may also pay monthly or annual fees that many payment gateways charge when creating a business account. Some providers also charge setup fees to set up accounts for the business. Companies must also pay PCI compliance fees to cover security standards for handling card data.

Lastly, chargeback fees. These are charged when customers request a refund for any reason. Unfortunately, the merchant has to bear the costs.

To Sum It Up

Payment processing helps businesses accept payment from customers. There are two types of payment processing: traditional and open banking. Open banking is relatively preferred for its benefits, such as lower transaction costs and ease of use.

It is vital for a business to have a flawless payment processing system because it enhances customer trust and conversion rates. It also prevents security concerns, which results in more customer retention.

Payment processing, which seems like a one-tap process, is actually a very complex process that requires on-point communication from multiple mediums. It has numerous components that make the transaction possible, including the merchant, customer, payment gateway, payment processor, issuing and acquiring bank, card validators, and security protocols.

If you need help with connecting Square with WordPress, try WP EasyPay.

Frequently Asked Questions

What is the meaning of payment processing?

Payment processing refers to the set of actions that follow when a customer initiates a payment either online or in person. The process includes everything from the payment gateway processing the information to the funds being deposited into the merchant’s account.

How do fraud detection tools in payment processing work?

Fraud detection tools in payment processing typically use a combination of data analysis, pattern recognition, and machine learning to identify atypical transactions that don’t follow the usual pattern. These tools may also check purchase history, billing information, device information, and transaction amount to find fraudulent activities.

What are payment processing fees?

Payment processing fees include transaction fees, monthly or annual fees, setup fees, PCI compliance fees, and chargeback fees that are charged when customers request a chargeback.