Starting a business has become easier than ever, thanks to Square. It facilitates all your business needs so you can focus on what actually matters: SELLING!

Well…Square helps you sell as well. At the moment, you must be thinking, “What is Square?”

Let us explain.

Square offers everything a business needs, from payment processors to accept payments to management and analytics tools to help you evaluate your business decisions and sales. Square is an all-in-one solution for all your business problems.

In this article, we will explore Square and its offerings in detail and assess how they can benefit your business.

Let’s get started!

What is Square? —Introduction

Square is a service that gives small businesses everything they need to start a business. From inventory management tools to payment processing solutions to send and receive payments in-person or online, all within one roof. By the time of writing, Square is available in the United States, Canada, Australia, Japan, the United Kingdom, the Republic of Ireland, France, and Spain.

The best part…it’s free. The only time Square makes money is when you make money. Simply put, Square charges a processing fee for every transaction your business makes.

Let’s understand the pricing model:

- In-person Square charges 2.6% + $0.10 per transaction on taps, dips, or card swipes.

- For eCommerce stores, 2.9% + $0.30 per transaction for purchases made through eCommerce API.

- When manually entering a customer’s card details, you pay 3.5% + $0.15 per transaction.

- When paying invoices, either in-person or online, you pay 3.3% + $0.30 per transaction.

- For ACH Bank Transfers, 1% with a $1 minimum transaction.

Square focuses on small and medium-sized businesses, with its free-to-start model and super ease of use, businesses choose Square over competitors.

Here’s a detailed look at each of their offerings:

- Square POS Services

Point-of-sale (POS) software is a business tool for managing sales, accepting payments, customer relationship management (CRM), employee management, reporting, analytics, and tracking merchandise. It is used by physical and online stores across industries.

On top of that, the app also has dedicated functions and features according to the industry. Square offers such feature-rich POS applications with every free account. The app runs seamlessly on both Android and iOS. The user-friendly application also has an offline mode, making it suitable for in-store sales. Square also offers dedicated POS software for retail, restaurant, and appointment-based businesses.

- Payment Processing

As we learned previously, Square’s main core feature is its payment processing qualities. Setting up a Square payment account is very simple. Instead of creating bank accounts or using third-party services, Square creates a central merchant account for you as soon as you create a free Square account. Upon account creation, you receive a sub or aggregate merchant account.

This makes it easier for Square to hold, receive, and disburse funds on your behalf. As a merchant, it makes it easier for you to accept payment via various services, including Apple Pay, Google Pay, Cash App, Afterpay, Gift Cards, etc.

Other payment options include:

- Cash, checks, vouchers, and other tenders

- Credit & debit card payments (Visa, Mastercard, American Express, Discover)

- Digital wallets

- HSA and FSA debit cards

- ACH

- Gift cards

- Buy Now, Pay Later (BNPL) with Afterpay

- Peer-to-peer payments with CashApp

???? Note: Wp EasyPay helps seamlessly integrate Square with WordPress and enables you to accept payment via all the above-mentioned payment options on your WordPress with just a few clicks.

- Square Marketing Tools

Marketing is a vital part of a business strategy. Having exact information on how your customers react to your business, products, and strategies can enable you to take calculated steps, eventually helping you create products and services that your customers love, helping you earn tons of revenue.

Unique marketing services allow you to create email campaigns, track analytics, send promotion messages via SMS or email, and offer numerous email templates.

However, please note that email marketing services are not free and will cost you money based on the number of emails you send.

Here’s how the pricing works:

- 0-500 Customer Contacts: $15/month

- 501-1,000 Customer Contacts: $30/month

- 1,001-2,000 Customer Contacts: $40/month

- 2,001-4,000 Customer Contacts: $55/month

- 4,001-9,000 Customer Contacts: $90/month

- Square Appointments

Square also offers a dedicated service for service-based businesses called Square Appointments. This application includes a built-in POS system and offers everything you need to run a small service-based business.

The service has a generous free plan and flat-rate transaction fees for paid plans. In both (free and paid) plans, you get automated reminders. It is rated 4.8/5 by Forbes Advisor, and many small businesses rely entirely on Square appointments to execute their business operations.

Lastly, looking at the downsides, their support team gets mixed signals, and critics often complain and express the need for rapid assistance and bash the app for taking extended periods to solve basic problems.

- Square Invoices

Freelancers, online business owners, small businesses, and every entity or organization that deals online require a professional way to request payments. Square Invoices was created for this sole purpose. The app offers a straightforward way to generate personal or business invoices and send them directly to the payer through email or SMS and receive payments via credit, debit cards, or direct bank transfer.

This service was rated 4.7/5 by Forbes Advisor.

- Square Payroll

As the name suggests, this app simplifies handling full-time, part-time, and contract-based employee payrolls. It also handles the tax filing and reporting. You can manually enter working hours or import time cards to accurately accumulate an employee’s monthly or weekly income.

If combined with Square Shifts—an employee shift management solution, you can also automatically calculate the commissions per sale by employees along with complete analytics about an individual’s working time.

Once you run payroll, employees will receive an email with a link to view their pay slips.

- Square Capital

As stated earlier, Square assists small businesses with everything. For businesses with tight budgets trying to scale up, Square provides easily accessible loan services to eligible businesses via Square Capital. The process is simplest, and you can get financial aid without filling out extensively lengthy forms.

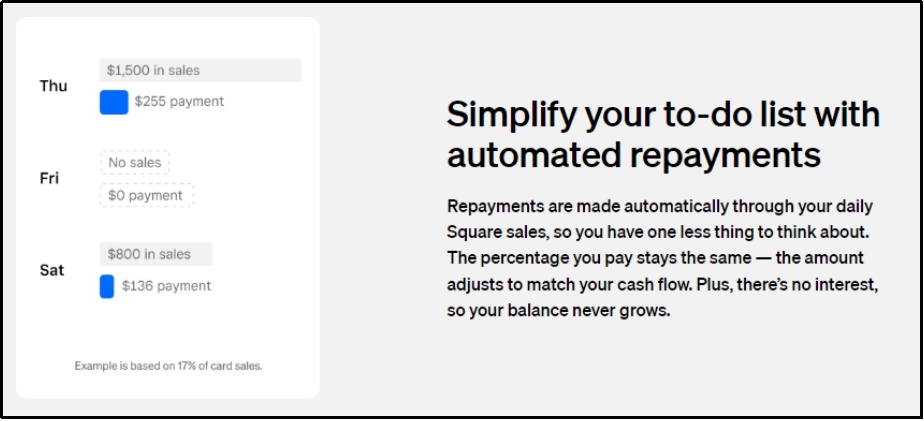

Currently, loans are offered by invitation. Simply put, Square monitors your processing activity and reaches out to you via email with your eligibility status and, if possible, a tailored plan. You don’t have to worry about paying back because that is automatically deducted from your sales and adjusted to your cash flow.

Remember what we said before? Square only makes money when you do. This image from the service’s page encapsulates the idea well.

Square has funded over 760K+ businesses, and 95% of them reported immense growth after acquiring a loan from Square.

Disadvantages of Square

Now that you know what is Square, what it offers, and its pricing, let’s take a look at the potential drawbacks of Square:

- Support: As discussed earlier, Square support gets mixed signals all around the web. Some claim it to be adequate, while others argue it’s slow and representatives are careless. Moreover, absurd support timings also raise eyebrows. Square only offers phone support from 6 a.m.–6 p.m. Pacific time, Monday to Friday. After the mentioned time, if a problem occurs that is causing you to lose business, you will lose until the support team gets back. Lastly, even if you call within the operation hours, you will still have to wait in the queue before a representative gets back to you.

- Payment Processing Fees: although Square processing fees are cheap, they are still not the best in the market. However, one must remember that Square is not only a payment processor but also a complete toolkit for small businesses. If you are only using it for payment processing purposes, then you might find dedicated services at cheaper prices.

- Account Freeze: If your business experiences excessive CNP frauds, such as chargebacks—that are not even the business owner’s fault, Square can freeze or suspend your account. This can be a significant setback for your business and can take ample time to resolve or set up an alternative service.

Final Remarks —What is Square?

Square is a complete solution for small businesses. It started back in 2009, and now, Square processes $210 billion every year. This unreal growth is prominent evidence of the enhanced usage of Square’s service.

Fortunately, for integrating this amazing service with your WordPress, we have WP EasyPay. It is a WordPress plugin that allows seamless integration of Square, allowing you to accept payments via the Square payment gateway.

Moreover, you can easily integrate multiple payment options with a few clicks. Want to learn more about Wp EasyPay and how it can help you integrate Square? Our support team is here to answer all your queries.

To integrate Square with your WordPress, try WP EasyPay today!

What is Square — Commonly Asked Questions

What is Square used for?

Square is usually used by small businesses for a variety of purposes. Square has an epic payment processor with cheap transactional fees, POS services, inventory and employee management tools, marketing tools, and much more. Businesses use it according to their preferred requirements.

Is Square free to use?

Creating a Square account is free and offers multiple useful services free of charge. However, some services can cost money depending on the service. Some services require an upfront fee, and others charge you upon transaction or sale. For instance, the processing rate is 2.6% + $0.10 for every tapped, dipped, and swiped payment.

Does Square work with contactless payments like Apple Pay and Google Pay?

Definitively! Square allows contactless payments for Apple Pay and GPay. Enable these services through Square’s POS app using a compatible Square reader. This should allow users to tap their phone to pay with their preferred mobile wallet.

Does Square offer any financing options for businesses?

Yes! Square offers multiple options for businesses, including loans, merchant cash advances, and buy now, pay later (BNPL) options. BNPL services allow store owners to allow interest-free (if paid on time) installment options to customers who are not comfortable paying higher prices.

Moreover, Square Capital offers rapid loan services for eligible businesses with zero interest rates. The returning policies are easy as well. The payback is deducted automatically from your sales.