Have you ever wondered how payment processors work?

You make a purchase on a website, and the payment is instantly accepted via a third-party payment processor. This is a pretty complex process, and multiple components are responsible for making a transition possible, yet it seems so fast.

To learn how payment works in its entirety, please refer to this article: Payment Processing Explained: What it is and How Does it Work. And to learn about third-party processors, keep reading this article.

In this article, we will address everything you need to know about third-party payment processors, how they work, and how you can choose the best one for your business.

Without further ado, let’s jump right in.

What are Third-Party Payment Processors?

Third-party payment processors, also known as payment aggregators, are entities that work as intermediaries between the merchant and the buyer and allow the buyer to make cashless payments, such as credit or debit card, online, or any other cashless payment method, without the need for setting up their own business account.

These payment processors make it easy for businesses to accept payment without the hassle of creating or registering a business account, which can be time-intensive and may or may not contain additional charges. Although these charges are minimal for large businesses, they can be significant for small businesses or businesses just starting with low capital.

With third-party payment processors, you don’t have to worry about setting up or maintaining a business or merchant account. Most processors allow you to create an account for free and only charge friction for your transitions, meaning they only make money when you do, saving you from paying upfront fees.

A few examples of payment processors include:

- Square

- PayPal

- Stripe

- BitPay

- Amazon Payments

- Stax, etc.

How do Third-Party Payment Processors Work

Third-party payment processors facilitate transactions between businesses and customers. They allow businesses to accept payments without directly handling sensitive payment information.

As discussed, creating a merchant or business account is time-consuming and imposes additional fees that a business must pay before creating an account. Third-party payment processors help businesses to overcome these charges. Instead of using your own account, you will use the third-party processor to complete the transaction. The third-party processor works as an intermediary facilitating the transaction.

Third-party processors are quick to set up and allow rapid transactions. For example, Square allows you to create an account and accept payments on the same day. If you need clarification on Square, check out this article for a detailed look at its features: What is Square?

Using your payment processor’s merchant account, the processor securely captures and reviews your customer’s payment information. The transaction also undergoes other anti-fraud measures before it is completed.

Key Benefits of Using Third-Party Payment Processors

Before you decide on using or not using third-party payment processors, here is why using a third-party payment processor can be a good idea:

- Reduced Cost

As discussed, using a third-party processor allows you to bypass several fees like merchant account fees, set-up fees, etc. If you are just starting, these costs can build up, so using a third-party payment processor can help you cut costs. However, the prices for each payment processor can vary. So, always check their official documents for an accurate estimation.

- Quick Solution

Creating a merchant or business account in most financial institutions can take ample time. Conversely, it is instant for third-party payment processors. All it takes is filling out a form, and the next notification you receive is from the payment processor congratulating you on opening your business account.

- Seamless International Payments

Usually, international payments require additional protocols and multiple data protection policies. If you use a third-party processor, you spare yourself all these tricky taxes and banking requirements. And since most processors automatically exchange currencies, international clients can seamlessly purchase your services without currency constraints.

- Enhanced Security

Third-party payment processors leverage the best security protocols to protect consumer data. Moreover, these processors also take care of identity verification and other fraud protection measures. Additionally, processor’s leverage tokenization and encryption policies to protect your customers’ data and ensure your business compliance with the necessary security laws.

Factors to Consider When Choosing a Third-Party Payment Processor

Before you rush to set one on your website, here are some factors to consider:

- Transaction Fees and Costs

Every third-party payment processor has different fee structures. Some processors may charge a flat fee per transaction, while others charge a monthly fee along with a transaction fee. So, it’s important to check the processor’s official document before choosing one.

Also, check out the public reviews and look for any hidden charges, such as termination or cancellation fees or any fees not directly and clearly disclosed on the website.

- Supported Payment Methods

Not all processors support various payment options, yet customers love having them. This helps enhance the conversion rate by allowing customers the flexibility to choose the payment they trust and always use.

- Security Features

We already discussed this, but it still can not be emphasized enough. Compliance with relevant security standards is vital for a business to operate. And legal problems have the potential to break a business down to closure completely.

Thus, always be mindful of the payment processor’s security practices and how they are progressing to meet the necessary security protocols. Such security protocols include PCI DSS (the Payment Card Industry Data Security Standard.)

- Integration and Compatibility

You need your processor to be compatible and integrate easily. Before selecting one, look for its integration options and what software it can easily integrate with. Choose one that offers easy integration with leading platforms and software, making accepting payment super easy and secure. Look for options such as:

- Point-of-sale software

- Loyalty program software

- Accounting software

- eCommerce specific software

- Sales tracking software

- Online booking software

- Customer Support and Reliability

You don’t only have to check for comments about hidden fees; you must also look for comments or testimonials accentuating the strengths or weaknesses of customer service and reliability.

Not having rapid customer service may shift the pressure on you when customers have an issue. Conversely, if the processor allows fantastic customer service, you can just reach out to them and sort out the problem immediately.

How to Integrate a Third-Party Payment Processor with Your WordPress [2 Easy Steps]

If you have considered everything mentioned above, here’s how you can integrate a third-party processor like Square into your WordPress using WP EasyPay.

Step #1: Install and Activate WP EasyPay

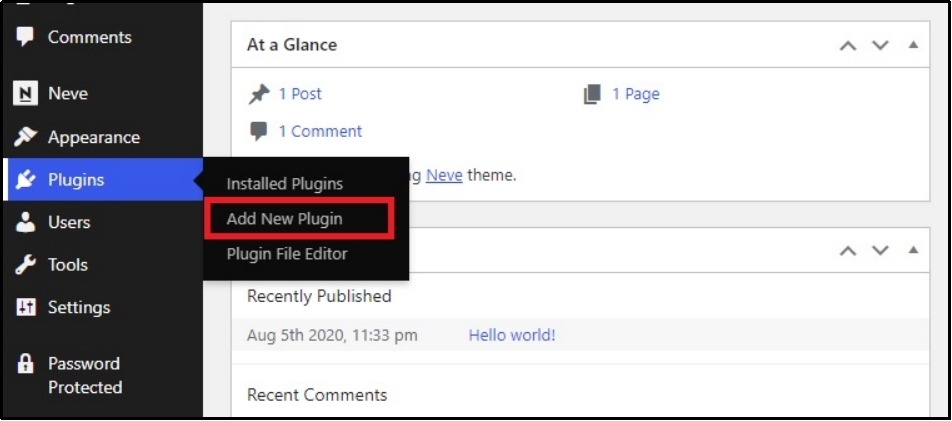

First of all, navigate to your WordPress dashboard, and hover over the ‘Plugins’ tab, and select ‘Add New Plugin’ from the menu.

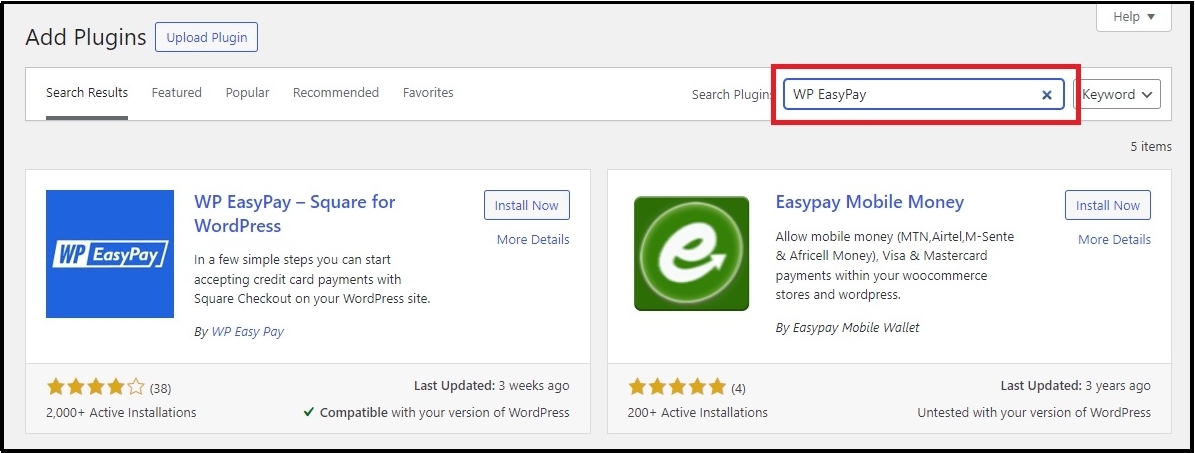

Search for WP EasyPay using the plugin search bar.

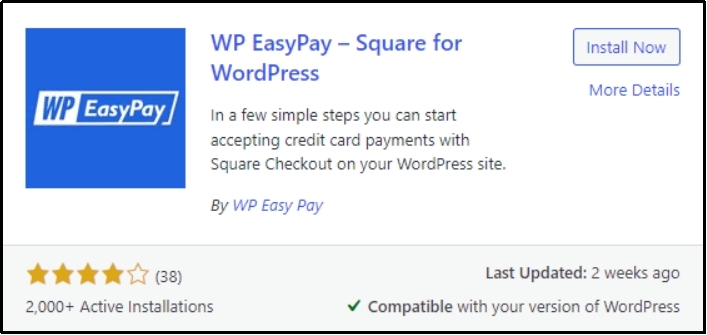

Click on the ‘Install Now’ button.

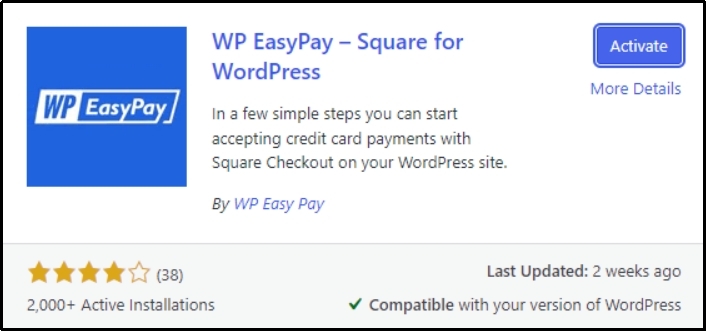

Once the installation finishes, click the ‘Activate’ button.

Step #2: Configure and Connect Square Sandbox Account

Next, you have to create a Square account and connect it via WP EasyPay.

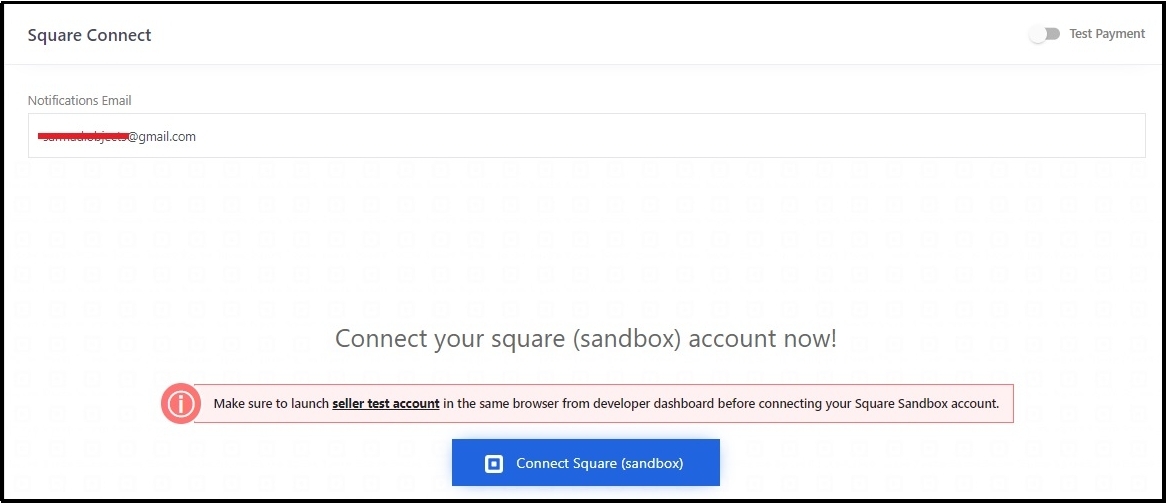

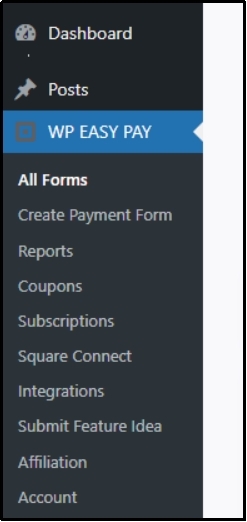

Firstly, go to the WP EasyPay’s settings from the WordPress dashboard and select Square Connect.

⚠️ Warning: The configuration will not work if you have not signed in on Square before. So, step back and create a free Square sandbox account if you haven’t yet.

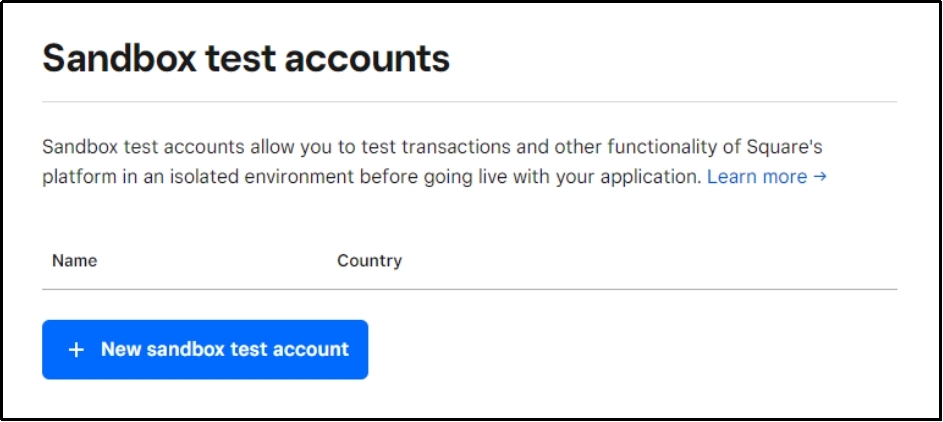

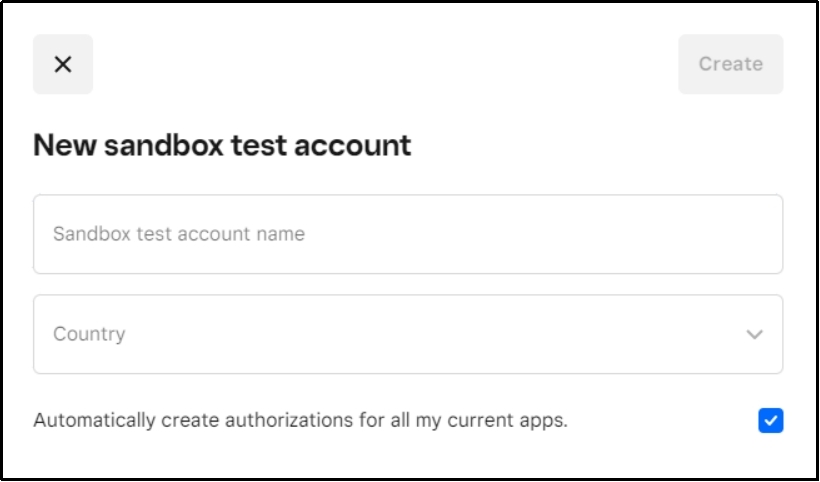

Click the ‘New Sandbox test account’ button to get a pop-up like this:

Put your Sandbox name in the first box, and select your country from the drop-down.

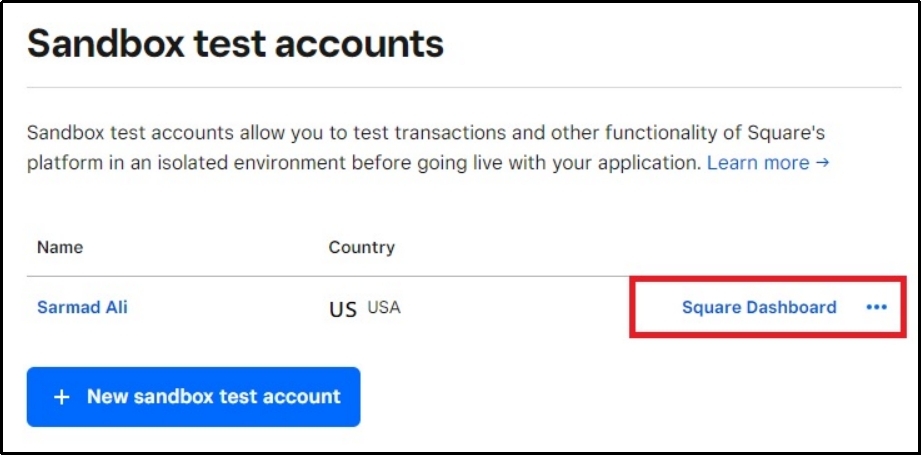

Click the ‘Square Dashboard’ button to reach your account dashboard.

Now open a new tab, and on that tab, go to your WordPress.

Navigate to the WP EasyPay >> Square Connect.

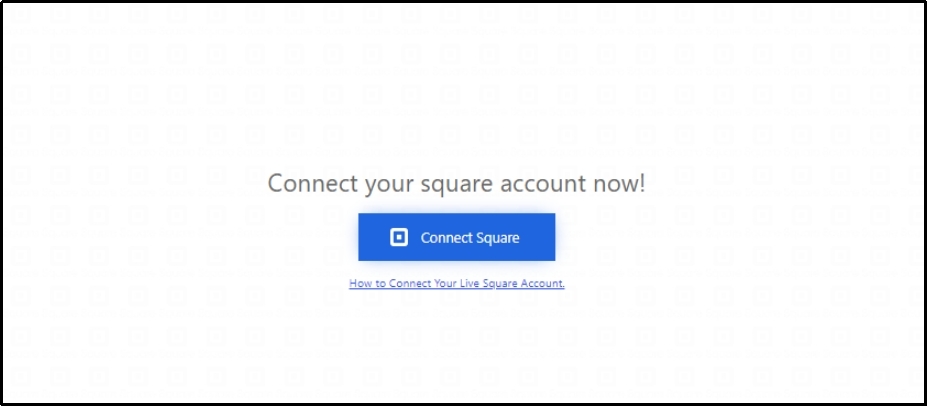

Click on the ‘Connect Square’ button.

The subsequent screen will ask you to log in to the Square account.

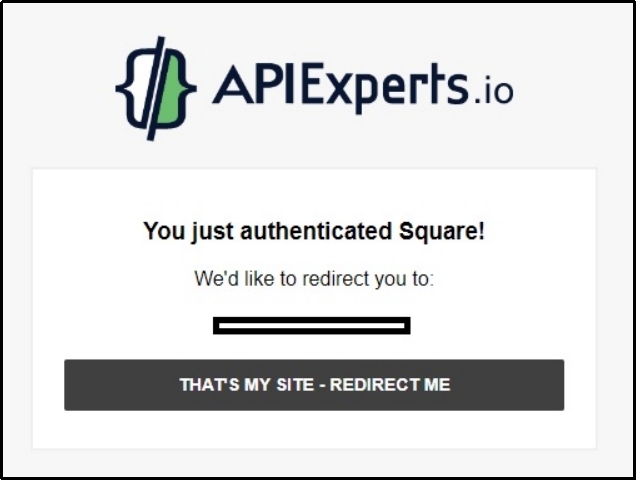

Login in, and you will see a screen like this:

Press the “THAT’S MY SITE – REDIRECT ME” button.

Lastly, enable the Test Payment option in the top right corner.

That will connect your Square account with WP EasyPay. That should connect your Square account with your WordPress.

WP EasyPay comes with a Gutenberg block, you can place it on your blogs or pages, and accept payments through a third-party payment processor (i.e., Square) on your WordPress.

Final Words

Choosing the best one from all the third-party payment processors can be difficult. However, there is no right or wrong answer. The best third-party processor for you is the one that offers adequate features for your business to run and operate correctly.

Moreover, you must consider their transaction fees and costs, supported payment methods, security features, integration options, compatibility concerns, and customer support efficiency.

Lastly, if you want to add a third-party payment processor like Square to your WordPress, try WP EasyPay.

Frequently Asked Question

Third-party payment processors work as intermediaries between the merchant and the buyer and allow the buyer to make cashless payments, such as credit or debit cards, without setting up their own business account.

A few examples of third-party payment processors include:

1. Square

2. PayPal

3. Stripe

4. BitPay

5. Amazon Payments

6. Stax, etc.

The third-party payment provider is often abbreviated to TPPP. Or TPPPs for third-party payment providers.