Merchant accounts and payment gateways are crucial for businesses using electronic payments like credit and debit cards. As an e-commerce business, providing online payments means diving into the culture of merchant accounts, payment service providers, and payment gateways.

You might need one or a combination of these components. Rest assured, we’ll untangle the confusion, explain the differences, and prepare you with the insights you need to establish a seamless payment processing infrastructure.

With this comparison blog, you’ll be ready to showcase your products, enable hassle-free purchases, and witness your hard-earned revenue flow.

???? Did you know?

The percentage of credit card payments increases with income: 34% for $100,000 to $149,999 and 44% for over $150,000.

In the upcoming sections, we’ll describe the concepts of merchant accounts and payment gateways, distinguishing their roles, exploring their symbiotic relationship, and discovering how merchant account and payment gateway functionalities work for businesses.

Merchant Account:

A merchant account is like your business’s money hub. It’s where the money from sales goes and stays until you move it to your actual bank account. Only authorized people in your business can access this account. So, when customers pay you, the money ends up in your merchant account before going to your bank.

Payment Gateway:

Think of a payment gateway as a bridge between your customers’ banks and merchant accounts. It helps move money from your customer’s bank accounts to your merchant account. Many businesses share one payment gateway for their customers.

A secure gateway makes sure the money reaches your account safely.

Types of Accounts and Gateways:

Payment Service Providers (PSP) vs. Independent Sales Organization (ISO)

For accounts, there are two common types: one is more accessible and suitable for small to medium businesses (PSP), and the other is more powerful and suits big companies (ISO).

PSP accounts are like the simple mode, and ISO accounts are like the expert mode. ISO accounts are better for big businesses, but they cost more upfront.

When it comes to gateways, there are classic and modern options. Classic ones need more setup, while modern ones like PayPal or Stripe are quick to set up and don’t always need a separate account.

Classic ones are better for serious businesses, even though they are more complicated. They also help your business look trustworthy and keep transactions smooth.

How Do You Choose a Payment Gateway Provider?

Similar to a merchant account, the suitability of a payment gateway hinges on your business type and specific requirements. Finding the right solution involves aligning with your company’s needs.

However, compatibility between payment gateways and certain merchant accounts or banks can be restrictive, potentially alienating specific customer segments. Thus, diversifying your payment options to cater to different preferences might be prudent.

While evaluating potential payment gateway providers, there are a few major inquiries to address. These queries will help determine if a particular provider aligns with your operational requirements.

- Diverse Payment Methods: Does the provider offer a broad spectrum of payment methods? While credit and debit cards remain popular, alternative forms like eWallets, mobile payments, and direct debits are critical to accommodate varying customer preferences.

- Fraud Prevention: In the virtual scenario, the specter of fraud looms large. Adequate fraud protection is essential for both consumers and businesses. Opting for a payment gateway with dedicated fraud prevention mechanisms is paramount. Neglecting fraud management could severely impact your business’s reputation.

By addressing these considerations, you can forge a confident path toward selecting a payment gateway that seamlessly integrates with your business and extends your customers a secure, versatile payment experience.

???? TIP: Find one that lets you work in your preferred money type for accounts. Always see if there are any hidden fees. If you do many transactions, ensure there’s no limit to how much you can process in a month.

The Comparison

Merchant Account vs. Payment Service Provider

1. Setup:

- Merchant Account: Involves a verification process and an agreement with an acquiring bank, taking several weeks.

- Payment Service Provider: Offers instant or fast setup, often without a lengthy verification process.

2. Stability:

- Merchant Account: Generally poses a lower risk of unjustified account holds or terminations.

- Payment Service Provider: Carries some risk due to account aggregation, potentially leading to account freezes or terminations.

3. Fees:

- Merchant Account: Fees can vary and are customized based on business needs and transaction volume.

- Payment Service Provider: Offers fixed flat-rate fees, which can be less expensive for smaller businesses.

4. Processing Volume:

- Merchant Account: Allows negotiation of terms and limits on processing volume and transaction size.

- Payment Service Provider: This may have limits on transaction volume and size.

5. User Experience:

- Merchant Account: Offers customization options for optimizing user experience.

- Payment Service Provider: Provides out-of-the-box solutions with limited customization.

Choosing the Right Option for Your Business:

The decision between a merchant account and a payment service provider depends on your business’s specific needs:

- Merchant Account: Ideal for businesses with higher transaction volumes and customization requirements. It offers a direct relationship with the account provider, potentially lowering fees.

Vs.

- Payment Service Provider: Suited for smaller businesses seeking simplicity and lower upfront costs. PSPs offer faster setup, streamlined operations, and fixed pricing.

???? TIP: For gateways, focus on security. Look for ones that follow the rules to keep transactions safe. Also, get one that works with many money types, especially if you have customers from different countries.

Also Read: Best Practices for Merchants to Handle Chargebacks!

Square | The Complete Payment Solution

Square is a complete payment solution that modernizes and simplifies the payment process for businesses. With its user-friendly tools and features, let’s quickly check out what Square offers.

- All-in-One Platform: Square provides a unified platform for accepting payments, managing sales, and tracking transactions. This eliminates the need for multiple systems, making your payment operations more efficient.

- Easy Setup: Setting up Square is easy, even for beginners. Its intuitive interface and step-by-step guidance ensure a smooth onboarding process.

- Contactless Payments: Square supports various payment methods, including contactless options like tap-to-pay and mobile wallets. This enhances convenience for both you and your customers.

- Invoicing and Online Payments: Generate and send invoices seamlessly, allowing customers to pay online. This feature simplifies the billing process and accelerates payment collection.

- Inventory Management: Square offers inventory tracking capabilities, helping you monitor stock levels and manage products more efficiently.

- Analytics and Reporting: Gain insights into your sales, customer behavior, and transaction history through Square’s analytics tools. This data-driven approach aids in making informed business decisions.

- Secure Transactions: Square prioritizes security, implementing encryption and compliance measures to protect your business and customer data.

- Customizable Solutions: Customize Square to your business needs by integrating various apps and add-ons from the Square App Marketplace.

Use Square with WP EasyPay

Simplify and enhance your WordPress payment processing experience with WP EasyPay, a global Square payments plugin that offers simplicity, speed, and security.

This plugin empowers your business to accept payments, reaching a wider audience and boosting conversion rates with an exceptional 99.9% uptime guarantee. Whether you’re initiating transfers at any time, WP EasyPay ensures a smooth payment journey for your customers.

WP EasyPay Features:

● Improved Form Builder:

- Change form appearance

- User-friendly interface

- Support for amount layout customization

- Drag-and-drop functionality

- Success URL redirection

● Improved Single Form Layout:

- User-friendly interface

- Simplified payment collection

- Drag and drop capabilities

- Predefined essential fields

- Enhanced form validation options

● Subscription Reports:

- Parent and child subscription reports

- Streamlined subscription tracking

- Categorization for easy management

- Transaction report review

● Subscription Pause & Run Functionality:

- Pause and run subscriptions

- Manage customers effortlessly

- Scheduled payment creation

● Multi-Step Form:

- Step-by-step tab interface

- Ideal for signups and payments

- Organized user data input

- Sequential step progression

- Option to use multi-step form layout

● Drag-&-Drop ‘Upload’ Fields:

- Easily add ‘UPLOAD FIELD’ option

- Users can attach important documents.

- Uploaded file view in the reports section

Installation Guide [Premium Version]

To enjoy the limitless features of WP EasyPay, you must upgrade to WP EasyPay premium. This section documents how you can easily upgrade your plan to enjoy premium features.

First and foremost, go here and choose a plan that fits your needs. After a successful purchase, you will receive the plugin in your inbox, along with the license key.

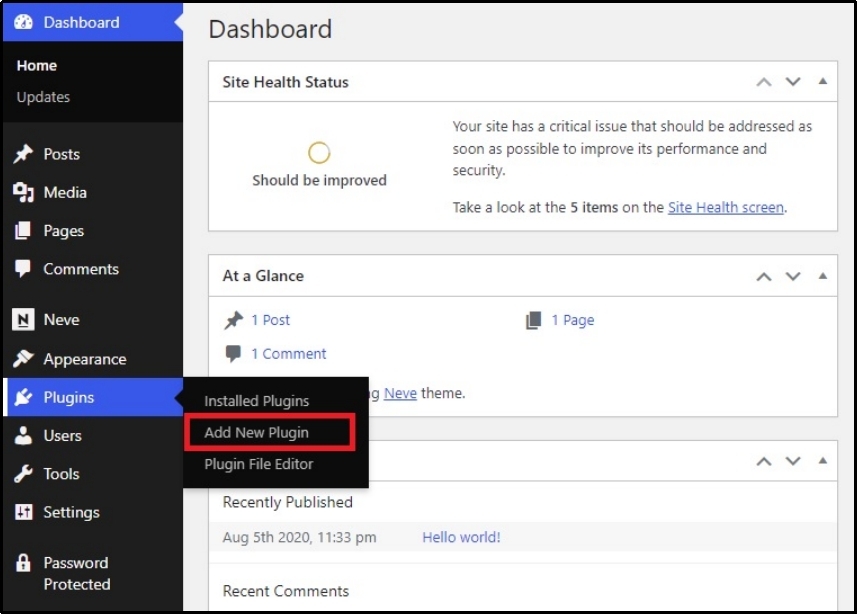

Afterward, login to your WordPress and navigate to Plugins >> Add New Plugin

At the top of the screen, you will see the Upload Plugin button, clicking it will reveal a tab allowing you to select files. Use the Choose File button and browse your newly bought plugin.

After selecting the ZIP file, use the Install Now button to begin installation.

Once the installation is complete, the following screen will appear. Select the Activate Plugin button to activate the plugin.

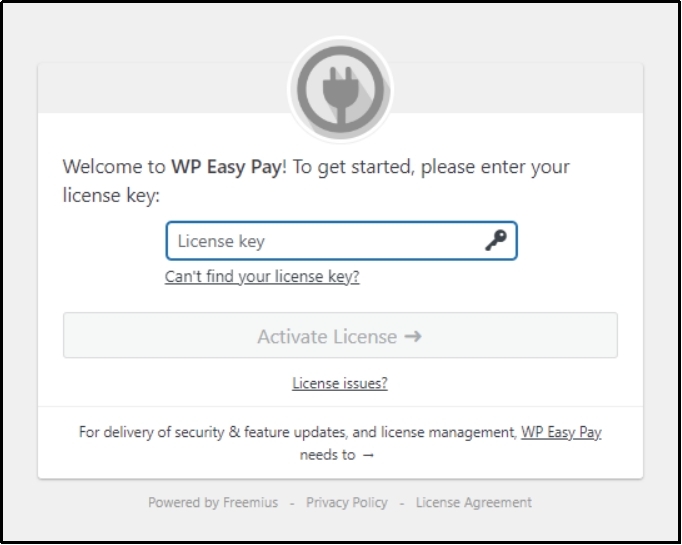

After activation, you will be required to enter your license key. Copy the key that you received with the plugin, paste it into the input box, and use the Activate License → button to activate the plugin.

For visual learners, below is the video tutorial…

Conclusion:

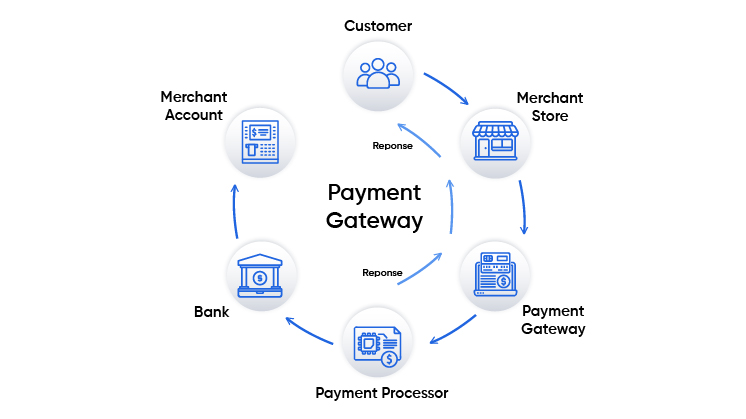

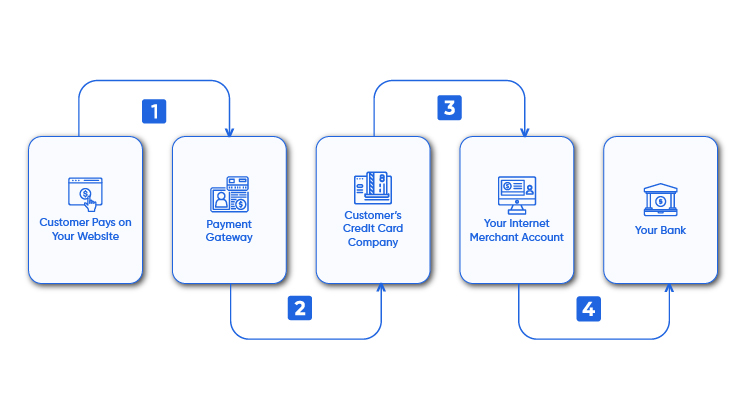

To start receiving online payments, you require a merchant account for handling the funds and a payment gateway for facilitating the transactions.

A merchant account can be obtained through a dedicated merchant services provider or by joining a payment services provider offering an aggregated merchant account solution. These two components work hand-in-hand to enable smooth money transfer during online transactions.

Consider your business’s size, transaction volume, customization needs, and budget when choosing the option that aligns with your goals.

Whether you opt for the control of a merchant account or the simplicity of a payment service provider, take your time to research and decide on the best fit for your business’s payment processing journey.

Frequently Asked Questions

What are Square transaction fees?

Square’s transaction costs vary by payment type. A fixed percentage of the transaction value is charged for in-person transactions. Some online transactions have different fees. For the latest fees, visit Square’s website.

What is the merchant account fee?

Banks or financial institutions that offer merchant accounts incur fees. This fee covers credit and debit card processing and account maintenance. Merchant account fees include transaction, monthly, and startup fees.

Is Square a merchant processor?

Yes, Square processes merchant transactions. Businesses can accept credit and debit cards with its tools and services. Square processes customer payments and deposits them into your business bank account.

Is Square a payment processor or gateway?

Square processes and gateway payments. It authorizes and collects consumer funds as a payment processor. Square’s payment gateway technology securely sends payment data between your website and financial institutions.

What’s the difference between a payment gateway and a payment processor?

Payment Gateway vs. Payment Processor:

Payment gateways securely transport payment information between websites and banking institutions. It protects sensitive data and simplifies communication. However, a payment processor processes the transaction backend. A payment gateway allows information flow, whereas a payment processor handles money transactions.