A payment chargeback is a transaction reversal initiated by a customer’s bank or credit card company. It occurs when a customer disputes a charge made to their account and requests that the payment be returned to them. The customer typically claims that the charge was fraudulent or that the goods or services were not received or were unsatisfactory.

The merchant who initially received the payment must provide evidence to the bank or credit card company to dispute the chargeback. If the merchant cannot provide sufficient evidence, the chargeback will be upheld, and the payment will be refunded to the customer.

Chargebacks can have significant financial and reputational consequences for merchants, so businesses need proper procedures to prevent and manage them.

How Does a Chargeback Work

As a startup entrepreneur, it’s essential to understand how payment chargebacks work, as they can significantly impact your business’s cash flow and profitability. A chargeback occurs when a customer disputes a payment made to your business, and the payment processor or bank reverses the transaction and refunds the customer’s money.

Here are some key things to keep in mind when it comes to payment chargebacks:

· Chargebacks can happen for various reasons, including fraud, unauthorized transactions, and customer dissatisfaction with the product or service they received.

· To minimize the risk of chargebacks, it’s important to have clear refund and cancellation policies in place and to provide excellent customer service to address any issues.

· Responding promptly and providing necessary documentation or evidence to support your case is essential if you receive a chargeback.

· In some cases, chargebacks can be prevented or disputed through a process known as represented, which involves submitting evidence to the payment processor or bank to challenge the chargeback.

However, it’s important to know that chargebacks can still result in fees and penalties. Too many chargebacks can lead to your business being flagged as high-risk and potentially even having your payment processing capabilities suspended or terminated.

Also read: https://wpeasypay.com/blog/successful-payment-processing-strategy/

What Are the Common Causes of Chargebacks

Here are some common causes of online payment chargebacks that online business owners should be aware of and some advice on how to mitigate them:

Fraudulent transactions:

One of the most common causes of chargebacks is fraudulent transactions. Fraudulent transactions can occur when someone uses a stolen credit card, or a customer claims they did not authorize a transaction.

Advice:

You can implement fraud detection tools to prevent fraudulent transactions and require additional verification steps, such as asking for a CVV code or implementing two-factor authentication.

Dissatisfied customers:

Customers may file a chargeback if dissatisfied with the product or service they received. They may also file a chargeback if they did not receive the product or service they paid for.

Advice:

Have clear policies and procedures for handling customer complaints and returns to prevent dissatisfied customers. You should also provide excellent customer service and communicate with your customers throughout the process.

Technical issues:

Sometimes technical issues can cause payment errors, which can result in chargebacks.

Advice:

Ensure your website and payment processing system are functioning properly and that you have a system to resolve any technical issues quickly.

Incorrect information:

Chargebacks can occur if a customer accidentally enters incorrect information during checkout, such as the wrong billing address or expiration date.

Advice:

Make sure your checkout process is user-friendly and provides clear instructions for entering payment information. You can also implement tools that validate the accuracy of the information entered by the customer.

Subscription-based services:

Chargebacks can occur if customers forget that they are subscribed to a service or need help understanding the terms and conditions of the subscription.

Advice:

So, you need to communicate the terms and conditions of your subscription service and provide reminders to customers before they are charged.

What Are the Best Practices for Merchants to Handle Chargebacks

Chargebacks can be a challenging and frustrating part of running an eCommerce store, but there are best practices that merchants can follow to help manage them effectively. Here are some tips:

Respond promptly:

Merchants should respond to chargebacks as soon as possible, ideally within the timeframe specified by the payment processor. This will help to prevent the chargeback from being automatically decided in favor of the customer.

Keep detailed records:

Merchants should keep detailed records of all transactions, including customer, purchase, and shipping information. This will be useful in disputing chargebacks and proving that the customer received the goods or services they paid for.

Use fraud prevention tools:

Merchants should use fraud prevention tools, such as AVS (Address Verification System) and CVV (Card Verification Value), to reduce the risk of fraudulent transactions.

Provide clear refund and cancellation policies:

Merchants should ensure their refund and cancellation policies are clear and understandable. This will help reduce the number of chargebacks filed due to customer misunderstandings.

Communicate with customers:

Merchants should communicate with customers throughout the purchase and after the sale to address concerns or issues. This can help to prevent chargebacks by resolving problems before they escalate.

Monitor chargeback ratios:

Merchants should monitor their chargeback ratios and take action if they exceed industry standards. High chargeback ratios can lead to account termination or increased fees from payment processors.

Work with a reputable payment processor:

Merchants should work with a reputable payment processor that offers chargeback management tools and support. This can streamline the chargeback process and reduce the burden on the merchant. Every reputed payment processor will help you have a report regarding a refund or chargeback. If you need a thorough report regarding the customer refund, WPEasyPay is the best option.

How WPEasyPay Works in Case of Chargeback:

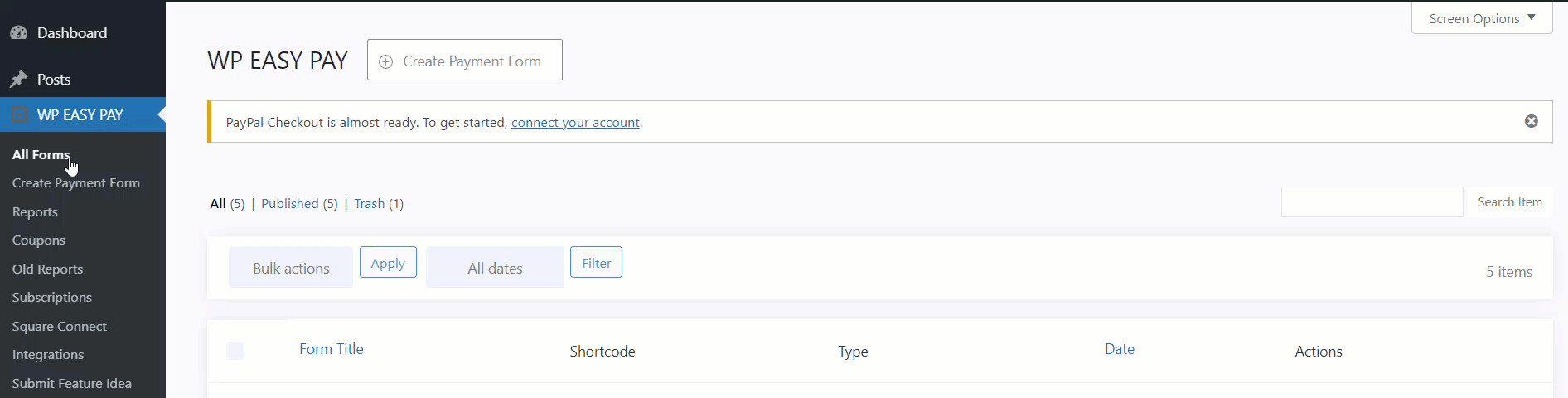

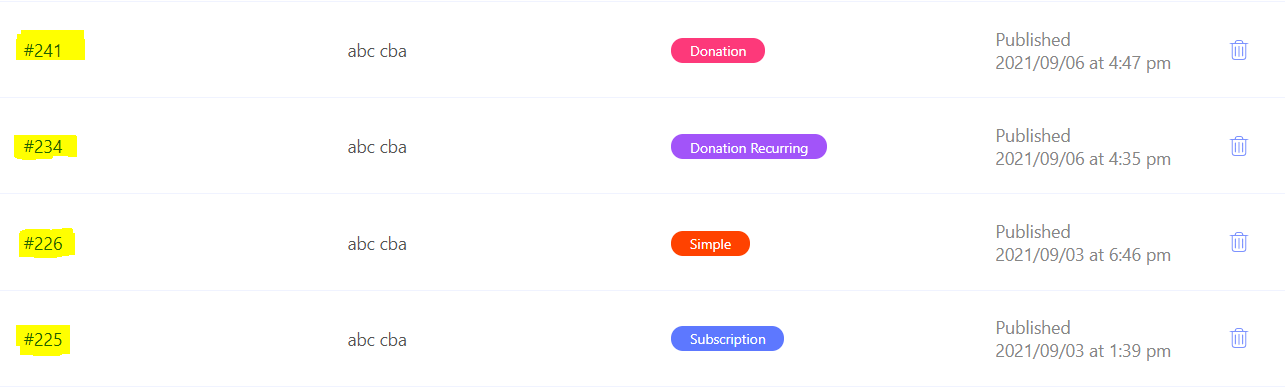

For merchants, WPEasyPay offers a feature called “Partial Refund Option”. This feature allows the client to collect their cash back from all the payment types in this plugin, including simple payments, donations, regular payments, and membership payments. The user can gain access to this functionality by following the steps below:

To apply this feature, click on the WPEasyPay from the WordPress dashboard. Here, you will get multiple features of the WPEasyPay Plugin. Users here can further choose the “Report” feature that displays every transaction recorded with the details such as

Transaction ID,

Name of the customer who paid that amount,

Type of the payment category,

Date of the transaction along with authority to delete the transaction.

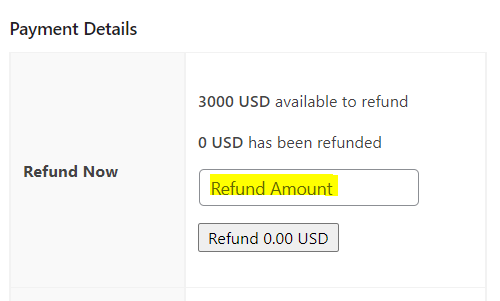

Here you can click on the transaction ID; the plugin will take you to the Payment Details screen, where you will find the Refund Now feature.

Details about the “Refund Now” Feature:

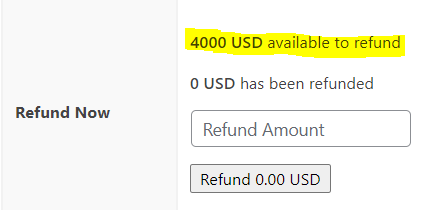

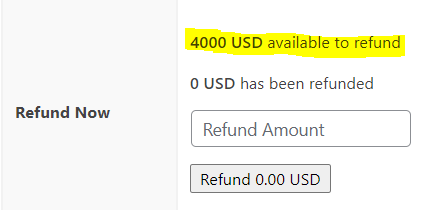

In the refund now feature, the user will be able to view the following details:

The total amount available for refund against the transaction recorded.

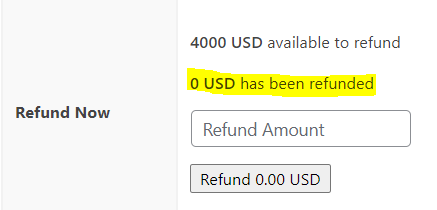

In the following highlighted section, the plugin mentioned the amount refunded to the customer after completing the refund process.

The mentioned amount will be updated if the user further initiates the refund payment process.

Empty Field, where the user can enter the amount that needs to be refunded to the customer.

Users can add the whole number figure or even decimal number figures.

A clickable button that shows the added amount (refunded) quantity and allows the user to confirm the refund request by clicking on the button.

Once the user clicks on this button, the plugin initiates the refund payment process, and a popup appears at the top of the screen to take confirmation before sharing the refund amount.

To confirm the refund, the user can click on the OK button, and in case of refund rejection, the user needs to click on the Cancel button.

After selecting the OK button, the plugin will continue the refund process, and after some second load time, payment has been refunded to the customer.

The status of the refunded amount is updated on the screen as well.

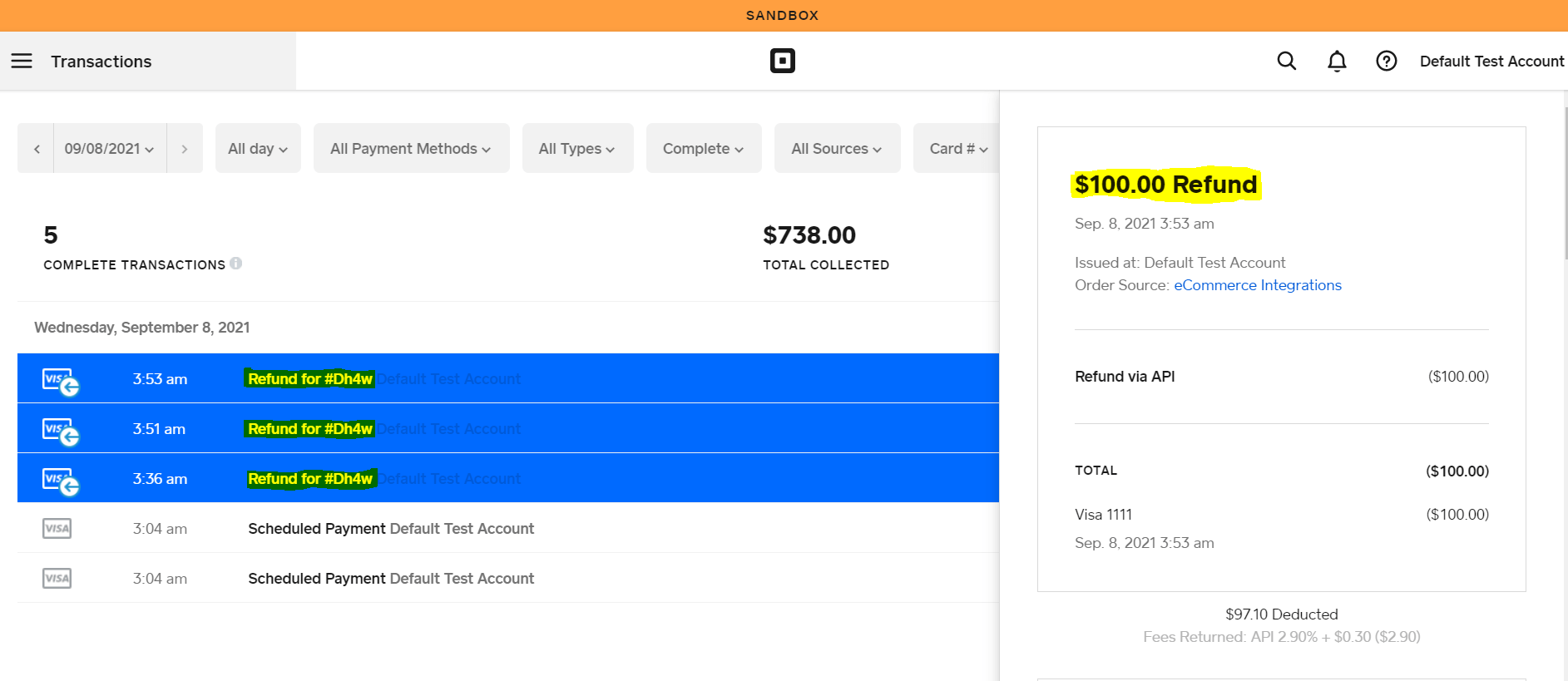

Refund ID Feature:

After completing the refund process, the plugin will record the refund transaction separately to maintain the record of each entry.

Plugin will generate the Refund ID on the same Build Report screen.

The user in their square account will use this automated and plugin-generated Refund ID to track this refund transaction.

What Are The Consequences Of Chargebacks For Merchants

Source: https://www.chargebackgurus.com/blog/chargeback-thresholds-what-they-mean-for-your-business

Chargebacks are the reversal of a credit card transaction by the bank, usually initiated by a cardholder disputing a transaction. Chargebacks can have significant consequences for online merchants, including:

Loss of revenue:

When a chargeback occurs, the merchant loses the payment for the sale, and in some cases, they may also incur fees or penalties from the payment processor.

Increased costs:

Chargebacks can increase the overall cost of doing business as they require time and resources to handle. Merchants may need to hire additional staff or outsource the chargeback process to a third-party service provider.

Damage to reputation:

Chargebacks can harm the merchant’s reputation if seen as unreliable or untrustworthy. Customers may associate chargebacks with poor quality or fraudulent products and services, leading to a loss of customer loyalty and decreased sales.

Loss of merchant account:

If a merchant experiences too many chargebacks, their payment processor may terminate their merchant account, making it challenging to continue accepting credit card payments.

Increased fraud risk:

High levels of chargebacks can be a sign of fraudulent activity, and payment processors may become more cautious when approving transactions from that merchant, leading to higher rates of declined transactions.

To minimize the impact of chargebacks, online merchants should implement measures to prevent chargebacks from occurring, such as verifying customer identities, providing clear product descriptions and terms of service, and offering responsive customer service. Merchants should also have a transparent chargeback management process and be proactive in addressing chargeback disputes to avoid the potential consequences of chargebacks.

Also read: https://wpeasypay.com/blog/how-digital-transformation-leveraging-payment-industry/

Wrap Up

Payment chargebacks can significantly impact merchants’ businesses, and merchants must understand how to prevent them. By educating yourself about chargebacks and implementing strategies such as fraud prevention, proactive communication with customers, and dispute resolution policies, you can minimize your risk of experiencing a payment chargeback. With this knowledge, you can confidently accept customer payments without worrying about the costly consequences.

FAQs

Can customers initiate a chargeback for any reason?

Customers can only initiate a chargeback if they have a legitimate reason. While Finance helps customers initiate a cashback process, it is ultimately up to the customer to provide sufficient evidence that their desired chargeback is justified.

Can merchants appeal a chargeback decision?

Yes, merchants can appeal a chargeback decision. To initiate the process, they must contact their bank and the relevant payment service provider to request a reversal or chargeback dispute. Merchants should provide details and evidence of the transaction and dispute any inaccuracies in the information provided by the customer.

How do chargebacks affect a merchant’s credit score?

Chargebacks can harm a merchant’s credit score. When customers initiate a chargeback, it could indicate to a credit company that the merchant needs to take proper steps to protect its customers and could create issues with the company’s credibility.