Recently, GoDaddy revealed its agreement to acquire a payment service provider, Poynt. GoDaddy’s chief software specialist (expert in private equity), Thoma Bravo, announced that the domain hosting giant plans to buy Realpage. Do you know why GoDaddy acquired these businesses? Because the mentioned lucrative deals signify the emerging trend of Integrated Payments.

What Are Integrated Payments

Integrated payments refer to seamlessly integrating payment processing functionality into a WordPress plugin or payment platform, allowing businesses to accept payments directly through their website. When a customer completes a transaction on a WordPress site, the payment is processed immediately, and the funds are transferred to the business’s account without any manual intervention.

In the context of WordPress, integrated payments can be facilitated through various payment gateways, such as PayPal, Stripe, and Square. These payment gateways typically offer WordPress plugins or integrations that allow businesses to add payment functionality to their website easily.

How Can a Business Benefit from an Integrated Payment System

A technology called an integrated payment system (IPS) streamlines many payment options onto a common platform. Businesses can now take payments through various channels, including credit and debit cards, IBFT, mobile payments, and digital wallets, with the help of the online payment process’s simplification. This post will review the advantages of an integrated payment system for businesses.

Increased Efficiency:

An integrated payment system eliminates manual payment processing. Businesses can automate payment acceptance and processing, reducing errors, delays, and costs associated with manual payment handling. IPS simplifies accounting tasks by consolidating payment data into a single platform, providing businesses with real-time payment data that can be used for forecasting and planning.

Improved Customer Experience:

An IPS offers customers multiple payment options, making it easy to pay for goods and services using their preferred payment method. This increases customer satisfaction and reduces the likelihood of abandoned carts due to payment issues. Also, an integrated payment system allows businesses to offer customized payment plans and subscriptions, improving customer retention.

Enhanced Security:

An IPS provides security measures to protect sensitive payment information like credit card numbers and bank account details. This helps businesses comply with industry regulations like the Payment Card Industry Data Security Standard (PCI DSS). IPS can also help reduce the risk of fraud and chargebacks by providing businesses with fraud detection and prevention tools.

Increased Sales:

An IPS can increase sales by allowing businesses to accept payments from various channels, including online, mobile, and in-store. This increases accessibility and convenience for customers, leading to increased sales. Moreover, an IPS can help businesses target new markets and customers by providing popular payment options in different regions.

Reduced Costs:

An IPS can reduce costs associated with payment processing by consolidating payment data into a single platform, reducing the need for multiple payment processing systems. This can also reduce costs related to chargebacks, fraud, and errors. Additionally, an IPS can provide businesses access to lower transaction fees and processing rates, resulting in significant cost savings over time.

Integrated Payment Methods VS Traditional Payment Methods

Integrated and conventional payment methods are two distinct ways of processing transactions. While traditional payment methods are the older, more established way of accepting payments, integrated payment methods have gained significant popularity in recent years due to their convenience and ease of use. Here’s a contrasting analysis of the two:

Technology:

Integrated payment methods are powered by modern technology and typically require a mobile device, computer, or internet connection. Traditional payment methods, on the other hand, often rely on older technologies like paper checks, cash, and credit card terminals.

Security:

Integrated payment methods often use encryption and tokenization to protect sensitive customer information, while traditional payment methods rely on physical security measures like safes and security cameras.

Convenience:

Integrated payment methods offer greater convenience than traditional payment methods. With integrated payment methods, customers can complete transactions quickly and easily without carrying cash or writing checks. Traditional payment methods require more effort from customers and can be time-consuming.

Integration:

Integrated payment methods can be easily integrated with other business tools and software, such as inventory management systems and customer relationship management software. Traditional payment methods can also be integrated but may require more manual intervention and work.

How WP EasyPay Can Streamline Your Business Operations

Easy to Grab User Interface:

A user interface (UI) is the graphical layout of a website, which includes the design, color scheme, and navigation. WP EasyPay has a clean and easy-to-navigate interface with a modern design and a blue & white color scheme.

Payment Processing:

WP EasyPay allows merchants to accept payments online through various payment methods, including credit cards, debit cards, and e-checks. Customers can securely make payments through the platform, and merchants can manage their payments and transactions in one place.

Integration:

WP EasyPay integrates with various e-commerce platforms, shopping carts, and content management systems (CMS) to streamline the payment process for merchants. Popular integrations include WooCommerce, Shopify, and Magento.

Security:

Security is one of the key aspects when choosing an integrated payment service provider. WP EasyPay ensures the highest level of security for its customers. WP EasyPay uses advanced encryption and security technologies to protect customers’ sensitive information, such as credit card details and personal data.

Customer Support:

The WP EasyPay website provides detailed documentation, including how-to guides and FAQs, to help users navigate the platform. They also offer email and phone support to assist customers with any issues.

Pricing:

WP EasyPay has transparent pricing with no hidden fees. They charge a transaction fee based on the payment method used and offer different pricing plans to suit various business needs.

The Steps To Setting Up Integrated Payments For Your Business

Every business has a website. To have an integrated payment system for your business, your website needs an extension or plugin to have smooth payment processing for your customers. There are various plugins in the market, but one of the most reliable you will get is WP EasyPay.

Here we will be using WP EasyPay as our integrated payment plugin that any business can use with their website designed on WordPress.

Step-by-Step Installation Guide:

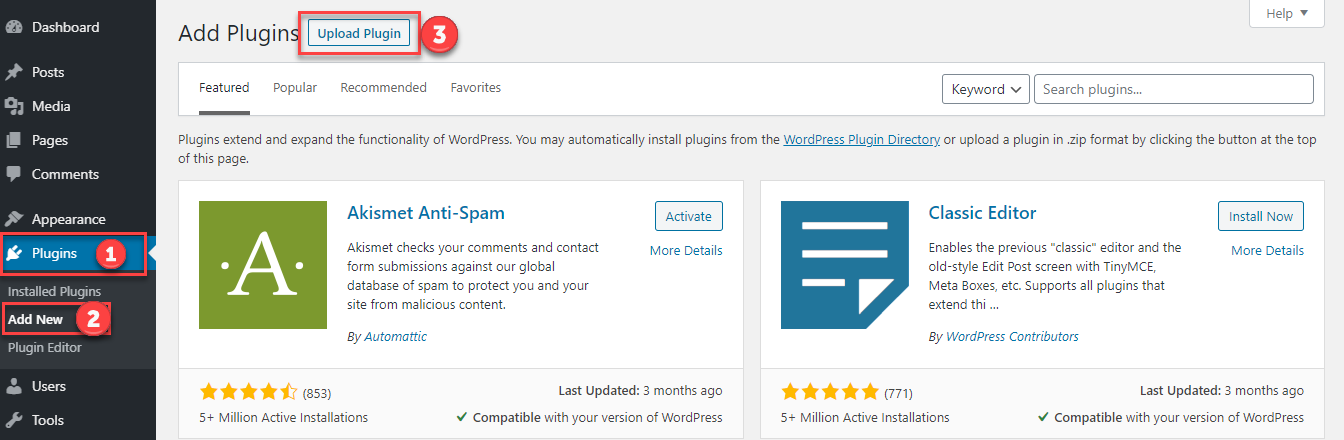

Go to plugins → Add New → Upload Plugin.

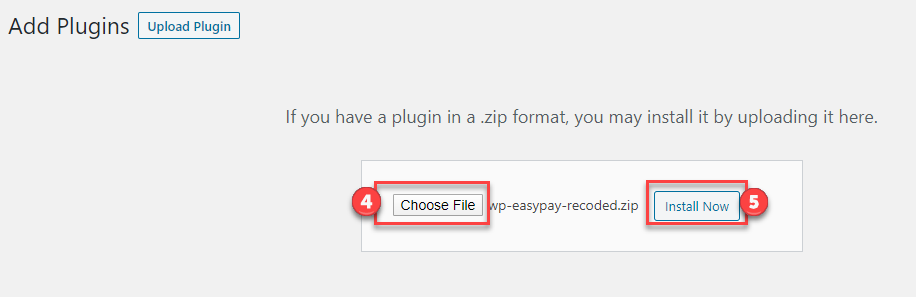

Choose file → Select WP-Easy-Pay → Upload.

Choose “Install Now.”

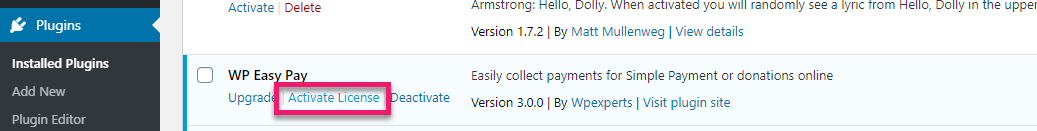

Now, navigate to Plugins → Activate License.

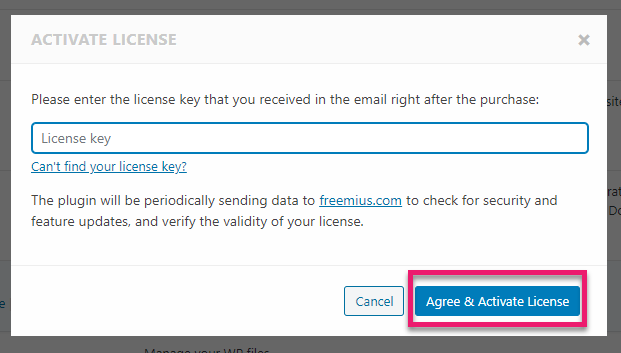

Enter the License Key and choose “Agree & Activate.”

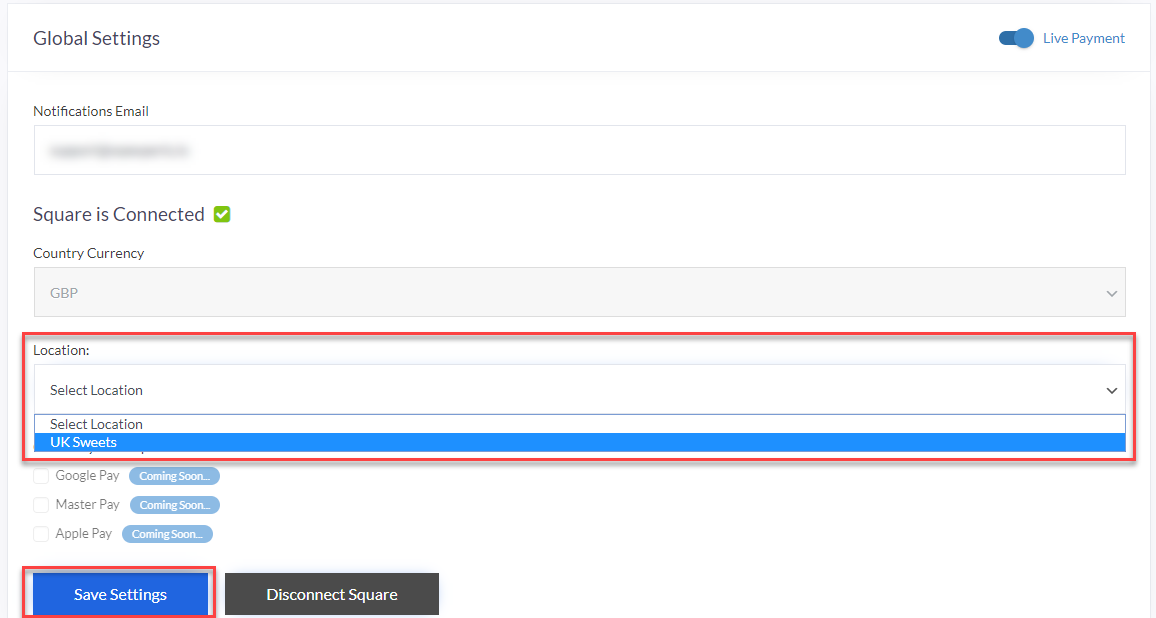

Now, considering your business use Square, follow the upcoming instructions to connect your Square account with WP EasyPay.

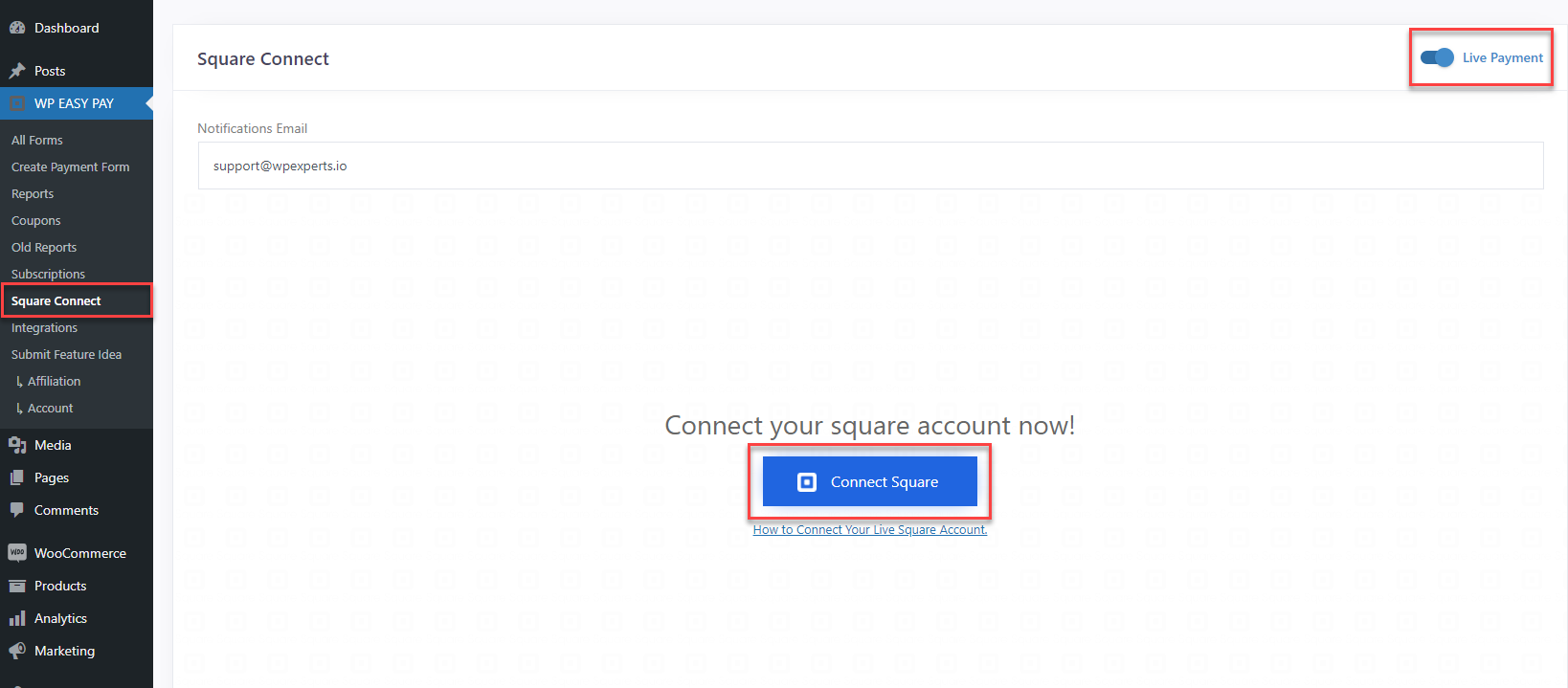

- Go to Square Connect.

- Turn on the Toggle on the top right to make it Live.

- Enter Notifications Email.

- Click Connect Square.

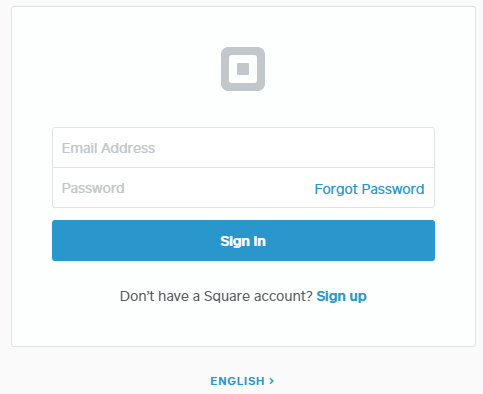

Input Square Credentials.

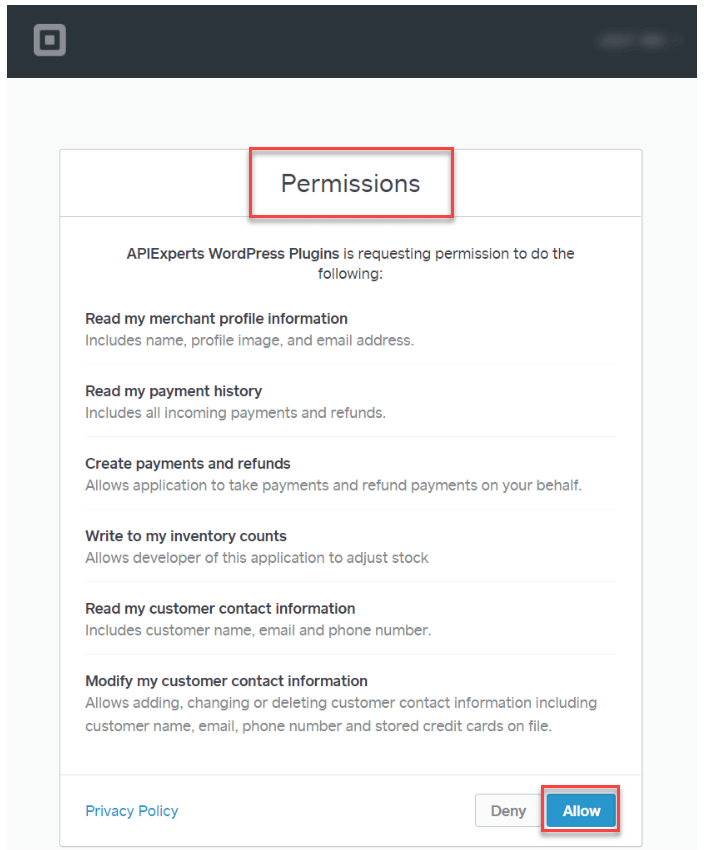

Allow Access for Permission.

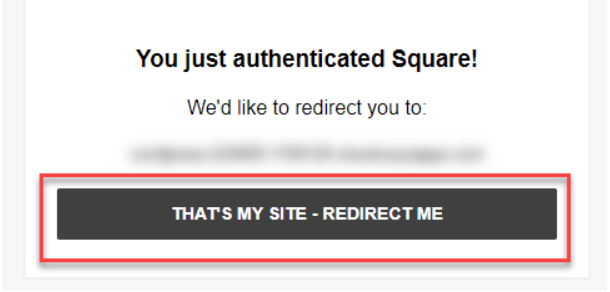

Click Redirect Me.

Choose “Location” and then “Save Settings.”

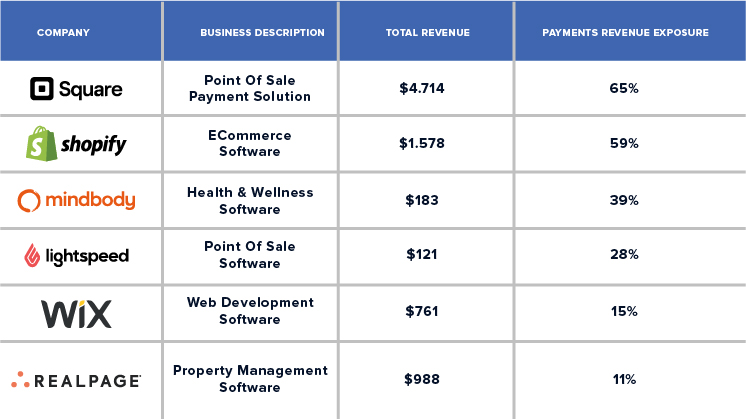

Use Cases – How Companies Successfully Implementing and Streamlining Integrated Payment Systems

There are various companies that are finding integrated payments as their savior. Following is the snapshot of renowned companies using digitally integrated payment processing methods:

1- Big Time

A tool called BigTime aids professional service companies in tracking and managing their assignments. Strong features of the system include project management, reporting, billing, and payments, as well as time and expense monitoring.

How Integrated Payment Solutions Making their Lives Easy

One of BigTime’s platform’s most outstanding features is that it extends beyond project management. Additionally, the solution aids businesses in continuing operations even after project targets have been reached. How? By providing features for invoicing and payments.

BigTime includes built-in billing features that let users create invoices directly from the app. Also, their users can acknowledge and handle credit card and ACH payments using the platform’s Wallet functionality.

2- ProfitSolv

ProfitSolv offers invoices, payments, and software solutions for legal, accounting, and professional services. The business has created a range of practice management software to assist law firms and accounting firms in managing their practices.

How Integrated Payment Solutions Making their Lives Easy

ProfitSolv’s invoicing capabilities include integrated payments. The ability to accept eChecks, ACH, and credit card payments is one of the site’s top advantages, which the business highlights.

Surcharging is another feature that ProfitSolv users can use to pass on transaction charges to customers and cut down on online payment fees.

Tips for Businesses to Ensure a Successful Integrated Payments Setup

Here are some tips for businesses to ensure a successful integrated payments setup:

Research and Choose a Reliable Payment Provider:

Choose a reliable payment provider with a secure and flexible payment gateway supporting multiple payment methods. Ensure that the payment provider complies with all necessary regulations and industry standards.

Analyze Your Business Needs:

Analyze your business requirements to determine the payment methods best suit your customers. Evaluate the volume of transactions, the types of payments, and the frequency of transactions.

Customize Payment Experience:

Customize your payment experience to meet your customers’ needs. This includes creating a branded checkout page that is user-friendly and easy to navigate.

Ensure Security:

Ensure your payment system is secure using encryption and tokenization to protect sensitive customer data. Compliance with industry standards such as PCI-DSS is also essential.

Integrate Payment System with Business Processes:

Integrate the payment system with your business processes, such as accounting, inventory management, and customer relationship management. This will help streamline your operations and increase efficiency.

Monitor and Analyze Payment Data:

Monitor and analyze payment data regularly to identify any issues or trends. This will help you to make data-driven decisions and improve your payment system.

Wrap-Up

Integrated payments can streamline business operations in numerous ways. By enabling businesses to accept various payments and providing a seamless transaction experience for customers, integrated payments can significantly enhance efficiency, reduce costs, and improve overall customer satisfaction. With the increasing demand for digital payments, businesses that embrace integrated payments can stay ahead of the competition and deliver a superior customer experience.

FAQs

Can I use integrated payments with my existing accounting software?

Yes, you can use integrated payments with your existing accounting software. Many companies like WP EasyPay offer solutions that allow you to easily integrate payment options into your accounting software, making it easier to manage invoices and transactions.

How can integrated payments help me manage my cash flow?

Integrated payments can help manage your cash flow by providing a streamlined and simplified way to receive and make payments. You can quickly process invoices and accept credit/debit cards or ACH/online banking transfers from one centralized system, resulting in faster payment processing, reduced costs associated with manual processes, and improved visibility into your overall financial health.

Are integrated payments secure?

Yes, integrated payments are secure. Providers use advanced encryption technologies and other safety measures to protect your sensitive customer data and ensure your payments are secure.